Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dow Jones Rises 67.9% During Obama Presidency

- Thread starter catzmeow

- Start date

Dr.House

Lives on in syndication!

http://www.nytimes.com/2012/10/21/y...nl=todaysheadlines&emc=edit_th_20121021&_r=2&

Through Friday, since Mr. Obamas inauguration his first 1,368 days in office the Dow Jones industrial average has gained 67.9 percent. Thats an extremely strong performance the fifth best for an equivalent period among all American presidents since 1900. The Bespoke Investment Group calculated those returns for The New York Times.

The best showing occurred in Franklin D. Roosevelts first term, when the market rose by a whopping 238.1 percent. Of course, that followed a calamitous decline. When his term started, the Dow had fallen to one-fourth of its former peak. In 2008, the year before Mr. Obama took office, the Dow declined by roughly one-third.

After Franklin Roosevelt, the next-best market performances occurred under Calvin Coolidge, Bill Clinton and Dwight Eisenhower. These exceptionally strong markets helped all of them win the next election and the stock market is undoubtedly helping Mr. Obama, too, even if he isnt saying much about it.

Are you better off in the last 4 years? Absolutely. My IRA has grown by over 50% in the past 3 years.

This will really energize the poor....

Mr. H.

Diamond Member

What's the big deal. The stock market usually does better when there's a democrat in the White House.

Because of post #18 and included quote.

thereisnospoon

Gold Member

I'm confused. Wasn't it just a few months ago that Democrats were decrying Wall Street posting record gains while the average American suffered? Does this mean Democrats have come to embrace Wall Street?

They were busy cursing Wall Street and the evil 1%..

Now they sing Wall Street's praises.

The hypocrisy of liberals knows no bounds.

In reality, the DJIA USED to be a good measuring stick of the overall economic health of the country. The reason is those blue chip stocks were widely held for long periods of time.

Grandparents would buy stock in companies such as GM, Ford or Coca Cola and put the certificate in a safe deposit box until the kid turned 25. Buy and hold ruled the day.

Now huge sums of shares in even the most prestigious of Fortune 500 companies are traded in seconds. Bought one moment and sold the next. Billions of dollars of wealth are created in one moment and lost the next. Then are created once again.

The DJIA , NAZ and S&P are at a state where those indexes are disconnected from the US Economy.

Finally, Obama economic policies have absolutely ZERO to do with the stock markets.

In fact the markets are up IN SPITE of not BECAUSE of Obama.

I any event, the libs want this issue both ways.

As we all know, libs will use ANYTHING if it gives them political mileage.

They would sell their mothers to make a political deal, not only that they send her COD.

thereisnospoon

Gold Member

It's just Fed money printing and ludicrously low interest rates. Do people realize how stupid it is to have a 0% interest rate? It's supposed to only occur when the world is ending but that was 4 years ago.

Gas prices are up for the same reason. Hedge funds borrow for free and buy up commodities they know everyone needs.

Brilliant post!!!! Spot on!

- Nov 26, 2011

- 123,518

- 54,591

- 2,290

http://www.nytimes.com/2012/10/21/y...nl=todaysheadlines&emc=edit_th_20121021&_r=2&

Through Friday, since Mr. Obama’s inauguration — his first 1,368 days in office — the Dow Jones industrial average has gained 67.9 percent. That’s an extremely strong performance — the fifth best for an equivalent period among all American presidents since 1900. The Bespoke Investment Group calculated those returns for The New York Times.

The best showing occurred in Franklin D. Roosevelt’s first term, when the market rose by a whopping 238.1 percent. Of course, that followed a calamitous decline. When his term started, the Dow had fallen to one-fourth of its former peak. In 2008, the year before Mr. Obama took office, the Dow declined by roughly one-third.

After Franklin Roosevelt, the next-best market performances occurred under Calvin Coolidge, Bill Clinton and Dwight Eisenhower. These exceptionally strong markets helped all of them win the next election — and the stock market is undoubtedly helping Mr. Obama, too, even if he isn’t saying much about it.

Are you better off in the last 4 years? Absolutely. My IRA has grown by over 50% in the past 3 years.

I'm sure the 12 million unemployed, the 46 million on food stamps, and the 23 million underemployed are comforted.

.

Last edited:

Gas prices: US city average price gasoline all types has increased 109.5% from Jan 2009 to Sep 2012.Good for you. How are gas prices, unemployment, and grocery bills doing in the last four years?

Unemployment for September 2012 is the same as it was in January 2009: 7.8%

Groceries: US city average food at home has increased 5.8% from Jan 2009 to Sep 2012.

All numbers seasonally adjusted.

The market has gone up because

1.) When Obama took office, the market was discounting a depression. We didn't have one. That is as much on Bush as it is on Obama, but Obama gets some credit. In the Spring of 09, stocks were extremely cheap relative to forward earnings. When Depression 2.0 didn't materialize, stock valuations normalized and stocks rose.

2.) Quantitative easing.

3.) Corporate profits have risen, in part due to firing lots of employees and not hiring them back.

1.) When Obama took office, the market was discounting a depression. We didn't have one. That is as much on Bush as it is on Obama, but Obama gets some credit. In the Spring of 09, stocks were extremely cheap relative to forward earnings. When Depression 2.0 didn't materialize, stock valuations normalized and stocks rose.

2.) Quantitative easing.

3.) Corporate profits have risen, in part due to firing lots of employees and not hiring them back.

Last edited:

I'm confused. Wasn't it just a few months ago that Democrats were decrying Wall Street posting record gains while the average American suffered? Does this mean Democrats have come to embrace Wall Street?

They were busy cursing Wall Street and the evil 1%..

Now they sing Wall Street's praises.

The hypocrisy of liberals knows no bounds.

In reality, the DJIA USED to be a good measuring stick of the overall economic health of the country. The reason is those blue chip stocks were widely held for long periods of time.

Grandparents would buy stock in companies such as GM, Ford or Coca Cola and put the certificate in a safe deposit box until the kid turned 25. Buy and hold ruled the day.

Now huge sums of shares in even the most prestigious of Fortune 500 companies are traded in seconds. Bought one moment and sold the next. Billions of dollars of wealth are created in one moment and lost the next. Then are created once again.

The DJIA , NAZ and S&P are at a state where those indexes are disconnected from the US Economy.

Finally, Obama economic policies have absolutely ZERO to do with the stock markets.

In fact the markets are up IN SPITE of not BECAUSE of Obama.

I any event, the libs want this issue both ways.

As we all know, libs will use ANYTHING if it gives them political mileage.

They would sell their mothers to make a political deal, not only that they send her COD.

Good post.. Love the observation about how the "retail" side of trading has changed. The E-Trade Baby takes over from the safe deposit box..

But here's the deal ---- create VALUE in the market.. Start making STUFF again and this trading volatility will fade.. They may love robo-trading and the challenges of working the edges of the market. But traders will sit on VALUE ---- just like Gramps and Grams did...

- Oct 7, 2011

- 38,401

- 4,162

- 1,130

Wall Street is Evil. It looks like one Obamabot didn't receive their programming. It's always hilarious watching OWS/Obamabots boasting about increased Wall Street profits. They're so damn confused. Do they love Wall Street, or do they hate it? They just can't make up their minds.

- Oct 7, 2011

- 38,401

- 4,162

- 1,130

Today Liberals support the 1% on Wall Street, and forget the 99%... Tomorrow the 99% get their due, and the 1% get dumped on. Hypocrites without shame.

Yeah, where did all those USMB OWS-posers go? Oh that's right, now they're back here boasting about increased Wall Street profits. Just more proof OWS was a DNC-manufactured scam.

catzmeow

Gold Member

- Thread starter

- Banned

- #33

The NYTimes is playing loose and fast with numbers again..

I distinctly remember the market falling 50%, not the 30% figure that they cherry-picked by dates.

And even the math challenged realize that to recover from a 50% loss --- you need a 100% gain..

((I hope.. Maybe that's not the case with the Obama faithful))

THAT'S why the OP fails.... Don't CARE what it did on the day the Dear Leader was inaugurated.. I'm not impressed that's it's "kinda back" to kicking around 2007 numbers.. Meaning it's gone NO WHERE in about 5 years now..

Obama wasn't inaugurated until January 20, 2009. That's not cherry picking the dates.

catzmeow

Gold Member

- Thread starter

- Banned

- #34

http://www.nytimes.com/2012/10/21/y...nl=todaysheadlines&emc=edit_th_20121021&_r=2&

Through Friday, since Mr. Obamas inauguration his first 1,368 days in office the Dow Jones industrial average has gained 67.9 percent. Thats an extremely strong performance the fifth best for an equivalent period among all American presidents since 1900. The Bespoke Investment Group calculated those returns for The New York Times.

The best showing occurred in Franklin D. Roosevelts first term, when the market rose by a whopping 238.1 percent. Of course, that followed a calamitous decline. When his term started, the Dow had fallen to one-fourth of its former peak. In 2008, the year before Mr. Obama took office, the Dow declined by roughly one-third.

After Franklin Roosevelt, the next-best market performances occurred under Calvin Coolidge, Bill Clinton and Dwight Eisenhower. These exceptionally strong markets helped all of them win the next election and the stock market is undoubtedly helping Mr. Obama, too, even if he isnt saying much about it.

Are you better off in the last 4 years? Absolutely. My IRA has grown by over 50% in the past 3 years.

This will really energize the poor....

Aren't the poor part of the 47%? Why do you care about energizing them?

- Oct 7, 2011

- 38,401

- 4,162

- 1,130

http://www.nytimes.com/2012/10/21/y...nl=todaysheadlines&emc=edit_th_20121021&_r=2&

Are you better off in the last 4 years? Absolutely. My IRA has grown by over 50% in the past 3 years.

This will really energize the poor....

Aren't the poor part of the 47%? Why do you care about energizing them?

OWS-Poser.

Dr.House

Lives on in syndication!

http://www.nytimes.com/2012/10/21/y...nl=todaysheadlines&emc=edit_th_20121021&_r=2&

Are you better off in the last 4 years? Absolutely. My IRA has grown by over 50% in the past 3 years.

This will really energize the poor....

Aren't the poor part of the 47%? Why do you care about energizing them?

Why would the poor care about how the stock market is doing?

The poor could use some energizing... This just might do it, right...??

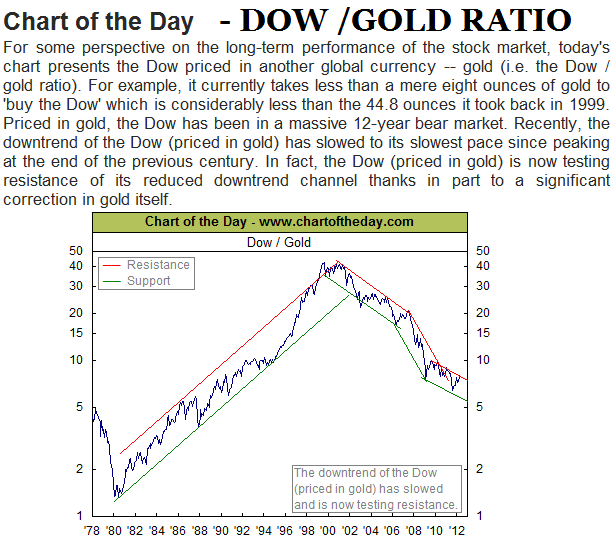

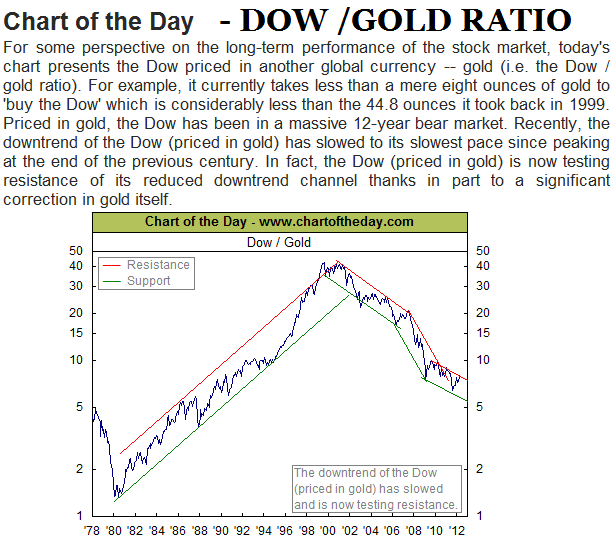

Dow/Gold Ratio.....tells the real story. We've been in a severe bear market since 1998

I guess by some of the brilliant insight being tossed around here,

the fact that the stock market was lower at the end of Bush's eight years than it was when he took office was somehow a good thing.

Didn't see anyone say that was a good thing, my point was you can't use a dollar for dollar comparison, because the dollar is worth less than 4 years ago. You can't have the fed printing money at these rates and maintain it's value. The economy is not expanding as fast as the money supply.

- Oct 7, 2011

- 38,401

- 4,162

- 1,130

I guess by some of the brilliant insight being tossed around here,

the fact that the stock market was lower at the end of Bush's eight years than it was when he took office was somehow a good thing.

Didn't see anyone say that was a good thing, my point was you can't use a dollar for dollar comparison, because the dollar is worth less than 4 years ago. You can't have the fed printing money at these rates and maintain it's value. The economy is not expanding as fast as the money supply.

Food & Gas Prices will continue to rise. I'm not sure even Romney can do anything about that. The mess is just too big at this point.

Similar threads

- Replies

- 35

- Views

- 2K

- Replies

- 203

- Views

- 15K

- Replies

- 15

- Views

- 534

Latest Discussions

- Replies

- 99

- Views

- 499

- Replies

- 24

- Views

- 121

Forum List

-

-

-

-

-

Political Satire 8029

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-