Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Do You Win Or Lose Under The GOP Tax Plan: Find Out For Yourself Here

- Thread starter g5000

- Start date

1 trillion out if 20 ~ so like when we reference our "borrowing" and always bring up ChinaThe percent of our debt held by foreigners has been climbing steadily. They own at least half, and China is the largest foreign lender.ok but borrow from china is a bit of hyperbole, and always has beenBob and Bill are neighbors.

Bob and Bill earn identical incomes.

Let's say $50,000.

Therefore, Bob and Bill pay identical income tax.

Let's say they each pay $5,000. A 10 percent tax on their income.

But wait!

Bill has exhibited some behaviors which he has demanded be rewarded by the government. Bill has purchased certain products and spawned.

So Bill gets to subtract $1,000 from his income tax.

Two guys earning identical incomes are now paying radically different amounts of tax.

Bob is paying $5,000, Bill is paying $4,000.

Now the government has collected $1,000 less in revenue.

The government has to make up for this loss somehow, or else borrow $1,000 from China.

So the government increases the 10 percent income tax to 11 percent.

Bob's tax bill is now $5,500. Thanks a lot Bill! Asshole!

Bob is now paying an extra $500 so that Bill can get his deductions.

Bob has been robbed by Bill.

Bill is next door, very excited about his deductions. "I get to keep more of my own money!"

Bill's tax bill is $5,500 - $1,000 = $4,500. Bill does not realize $500 of his deductions have been cancelled out by the tax rate hike!

But at least the budget is back in balance.

Bob and Bill both complain to the government that an 11 percent tax is too high. They are fucking pissed about it.

So the government lowers the tax rate back to 10 percent.

Woo hoo!

But the government only cuts a few of Bill's deductions which had caused the 11 percent tax rate to begin with.

Bill still gets $500 in deductions instead of $1,000.

Bob's tax bill is back to 10 percent. He pays $5,000. He's happy again.

Bill's tax bill is $5,000 - $500 = $4,500.

Bob and Bill's tax bills are STILL not the same! They are unequal.

And now the government has to borrow $500 from China due to the deficit.

That is what is going on with the Republican tax "reform" bill on the corporate side. The government has not cancelled out all the deductions, exemptions, and credits which caused the corporate tax rate to be so high to begin with.

They are cutting taxes, but not cutting tax expenditures which are a form of SPENDING.

our debt holders are mainly us citizens, not "china" as is popularly screeched

...its kinda like an okie doke.

NightFox

Wildling

That's not what I'm asking, what I'm curious about is how do you explain the difference; for example was it the loss of certain deduction(s)?I took my income earned in 2016 and plugged it into the GOP postcard tax return and the amount I would owe under the House plan is 29 percent higher than what I actually paid on my 2016 income tax return. I compared what the postcard return said I would to line 63 of my 1040 for 2016.Well, I just did mine, and I would pay more under the new plan than I did under the current plan.

29 percent more! That's a HUGE increase!

Dammit!

Just out of curiosity, how do you end up paying 29% more?

- Nov 26, 2011

- 123,561

- 54,953

- 2,290

- Thread starter

- #44

What pisses me off is that the corporate tax reform does not eliminate any significant tax expenditures which drove the tax rate to 35 percent to begin with.

They are lowering the tax rate without taking away all the government gifts which drove it so high.

So it is blazingly obvious an ass-rape of the individual taxpayer. We are all going to have a higher national debt and higher income taxes to keep those special interest government gifts alive.

FUCK. THAT. SHIT!

Time for a revolution.

They are lowering the tax rate without taking away all the government gifts which drove it so high.

So it is blazingly obvious an ass-rape of the individual taxpayer. We are all going to have a higher national debt and higher income taxes to keep those special interest government gifts alive.

FUCK. THAT. SHIT!

Time for a revolution.

from your link, read it close.ok but borrow from china is a bit of hyperbole, and always has beenBob and Bill are neighbors.

Bob and Bill earn identical incomes.

Let's say $50,000.

Therefore, Bob and Bill pay identical income tax.

Let's say they each pay $5,000. A 10 percent tax on their income.

But wait!

Bill has exhibited some behaviors which he has demanded be rewarded by the government. Bill has purchased certain products and spawned.

So Bill gets to subtract $1,000 from his income tax.

Two guys earning identical incomes are now paying radically different amounts of tax.

Bob is paying $5,000, Bill is paying $4,000.

Now the government has collected $1,000 less in revenue.

The government has to make up for this loss somehow, or else borrow $1,000 from China.

So the government increases the 10 percent income tax to 11 percent.

Bob's tax bill is now $5,500. Thanks a lot Bill! Asshole!

Bob is now paying an extra $500 so that Bill can get his deductions.

Bob has been robbed by Bill.

Bill is next door, very excited about his deductions. "I get to keep more of my own money!"

Bill's tax bill is $5,500 - $1,000 = $4,500. Bill does not realize $500 of his deductions have been cancelled out by the tax rate hike!

But at least the budget is back in balance.

Bob and Bill both complain to the government that an 11 percent tax is too high. They are fucking pissed about it.

So the government lowers the tax rate back to 10 percent.

Woo hoo!

But the government only cuts a few of Bill's deductions which had caused the 11 percent tax rate to begin with.

Bill still gets $500 in deductions instead of $1,000.

Bob's tax bill is back to 10 percent. He pays $5,000. He's happy again.

Bill's tax bill is $5,000 - $500 = $4,500.

Bob and Bill's tax bills are STILL not the same! They are unequal.

And now the government has to borrow $500 from China due to the deficit.

That is what is going on with the Republican tax "reform" bill on the corporate side. The government has not cancelled out all the deductions, exemptions, and credits which caused the corporate tax rate to be so high to begin with.

They are cutting taxes, but not cutting tax expenditures which are a form of SPENDING.

our debt holders are mainly us citizens, not "china" as is popularly screeched

As of September 2014 the largest single holder of U.S. government debt was China, with 21% of all foreign-held U.S. Treasury securities (10% of total U.S. public debt).[47] China's holdings of government debt, as a percentage of all foreign-held government debt are up significantly since 2000 (when China held just 6 percent of all foreign-held U.S. Treasury securities).[48]

National debt of the United States - Wikipedia

- Nov 26, 2011

- 123,561

- 54,953

- 2,290

- Thread starter

- #46

Look at the postcard. There aren't the many hundreds of deductions there used to be.That's not what I'm asking, what I'm curious about is how do you explain the difference; for example was it the loss of certain deduction(s)?I took my income earned in 2016 and plugged it into the GOP postcard tax return and the amount I would owe under the House plan is 29 percent higher than what I actually paid on my 2016 income tax return. I compared what the postcard return said I would to line 63 of my 1040 for 2016.Well, I just did mine, and I would pay more under the new plan than I did under the current plan.

29 percent more! That's a HUGE increase!

Dammit!

Just out of curiosity, how do you end up paying 29% more?

Yes, my tax return is pretty lengthy.

When I have been preaching about eliminating tax expenditures all these years, I have been quite willing to lose all my deductions, credits, and exemptions in exchange for a sane, fair, and simple tax system.

However, this GOP plan does not do that. It's a fucking shell game which has taken away a lot of individual's deductions, exemptions, and credits, but not removed any significant corporate government gifts. It has shifted the cost of the corporate deductions, exemptions, and credits onto the backs of the individual taxpayer.

If the American people had any clue what kind of ass-fucking this is, they'd be headed to the Capitol with torches.

NightFox

Wildling

So what was it that you lost that made that big of a difference? perhaps some examples?Look at the postcard. There aren't the many hundreds of deductions there used to be.That's not what I'm asking, what I'm curious about is how do you explain the difference; for example was it the loss of certain deduction(s)?I took my income earned in 2016 and plugged it into the GOP postcard tax return and the amount I would owe under the House plan is 29 percent higher than what I actually paid on my 2016 income tax return. I compared what the postcard return said I would to line 63 of my 1040 for 2016.Well, I just did mine, and I would pay more under the new plan than I did under the current plan.

29 percent more! That's a HUGE increase!

Dammit!

Just out of curiosity, how do you end up paying 29% more?

Yes, my tax return is pretty lengthy.

When I have been preaching about eliminating tax expenditures all these years, I have been quite willing to lose all my deductions, credits, and exemptions in exchange for a sane, fair, and simple tax system.

However, this GOP plan does not do that. It's a fucking shell game which has taken away a lot of individual's deductions, exemptions, and credits, but not removed any significant corporate government gifts. It has shifted the cost of the corporate deductions, exemptions, and credits onto the backs of the individual taxpayer.

If the American people had any clue what kind of ass-fucking this is, they'd be headed to the Capitol with torches.

Thanks but that has nothing to do with what I asked you.

DJT for Life

Gold Member

- Jun 21, 2017

- 3,468

- 899

- 195

Get out your 2016 tax return. Run your 2016 income through the new GOP plan.The issue is about state taxes not federal taxes,

The good folks of Illinois, Cali, New York, should pack up and leave

and they will get a big tax decrease.

In 1950 New York had 43 members of the House. Florida had 8. Last

election it was 27-27. Folks in upstate NY have been in a permanent

migration south for going on 70 years. In 2020 Florida will top New York

in the House and obviously in total population.

You don't like losing that credit for state taxes, then either elect people that will

lower your state taxes or move to Florida or Texas. Ain't no state tax

down here, and we're doing just fine.

Anybody that still resides in upstate New York is a total fool. Your infrastructure is falling down as I type. Hell, you are footing the bill

to keep New York City afloat.

C'mon down...the sun is shining bright.

I bet you pay more. Unless you're one of the 47 percent who pay no federal income taxes.

I'm retired and I've already gone thru the steps.

Big---Big Savings

Get out your 2016 tax return. Run your 2016 income through the new GOP plan.The issue is about state taxes not federal taxes,

The good folks of Illinois, Cali, New York, should pack up and leave

and they will get a big tax decrease.

In 1950 New York had 43 members of the House. Florida had 8. Last

election it was 27-27. Folks in upstate NY have been in a permanent

migration south for going on 70 years. In 2020 Florida will top New York

in the House and obviously in total population.

You don't like losing that credit for state taxes, then either elect people that will

lower your state taxes or move to Florida or Texas. Ain't no state tax

down here, and we're doing just fine.

Anybody that still resides in upstate New York is a total fool. Your infrastructure is falling down as I type. Hell, you are footing the bill

to keep New York City afloat.

C'mon down...the sun is shining bright.

I bet you pay more. Unless you're one of the 47 percent who pay no federal income taxes.

I'm retired and I've already gone thru the steps.

Big---Big Savings

Mrs Dog refigured this moring (JFC in the morning!) according to what she found of the most recent versions and we lose bigly under the senate plan, but may be around the same under the House if it keeps deductions for state taxes.

But the gop is admitting they'd pass a phonebook just to have something to pass, and this is about keeping congressional donors on board. They have no real clue as to what the effect will be on middle income earners.

Nobles Need Not Pay TaxesWell, I just did mine, and I would pay more under the new plan than I did under the current plan.

29 percent more! That's a HUGE increase!

Dammit!

You can't say us liberals didn't warn you. Here is what we were saying in 2005 about these rich Republican mother fuckers.

G5000 was warning the rubes not to vote for trump. I doubt he voted for Hillary. I sure the hell didn't, or the Oranguton either. I'd like to see my entire congressional delegation perish in a lobbyist paid for junket plane ride.Nobles Need Not Pay TaxesWell, I just did mine, and I would pay more under the new plan than I did under the current plan.

29 percent more! That's a HUGE increase!

Dammit!

You can't say us liberals didn't warn you. Here is what we were saying in 2005 about these rich Republican mother fuckers.

sartre play

Gold Member

- May 4, 2015

- 9,883

- 3,069

- 210

Its a very bad tax plan, they will shift the cost to the middle/ working class. they will do this no mater what, if we complain enough Maybe they will end up with just a bad tax bill. its worth a try. call your senator.

Well like I said we lose the child tax credit in 18, so it's a tough analysis.

And we're not sure if we get the extra deduction for being old as dirt anymore either.

but a middle class tax cut shouldn't even require such niceties. Lower the corp rate by eliminating stuff corps can deduct. Make that a separate bill. It'd be good for the economy.

come back and do income taxes, which if we're going to significantly lower the middle class rates, will have to include a VAT, and don't give the top quintile a lower rate. They already got theirs with corp tax relief.

It's not hard.

But this is the gop congressional donors relief bill. The gop has to let the 1% double dip in tax breaks so they fuck the rest of us.

And we're not sure if we get the extra deduction for being old as dirt anymore either.

but a middle class tax cut shouldn't even require such niceties. Lower the corp rate by eliminating stuff corps can deduct. Make that a separate bill. It'd be good for the economy.

come back and do income taxes, which if we're going to significantly lower the middle class rates, will have to include a VAT, and don't give the top quintile a lower rate. They already got theirs with corp tax relief.

It's not hard.

But this is the gop congressional donors relief bill. The gop has to let the 1% double dip in tax breaks so they fuck the rest of us.

iceberg

Diamond Member

- May 15, 2017

- 36,788

- 14,919

- 1,600

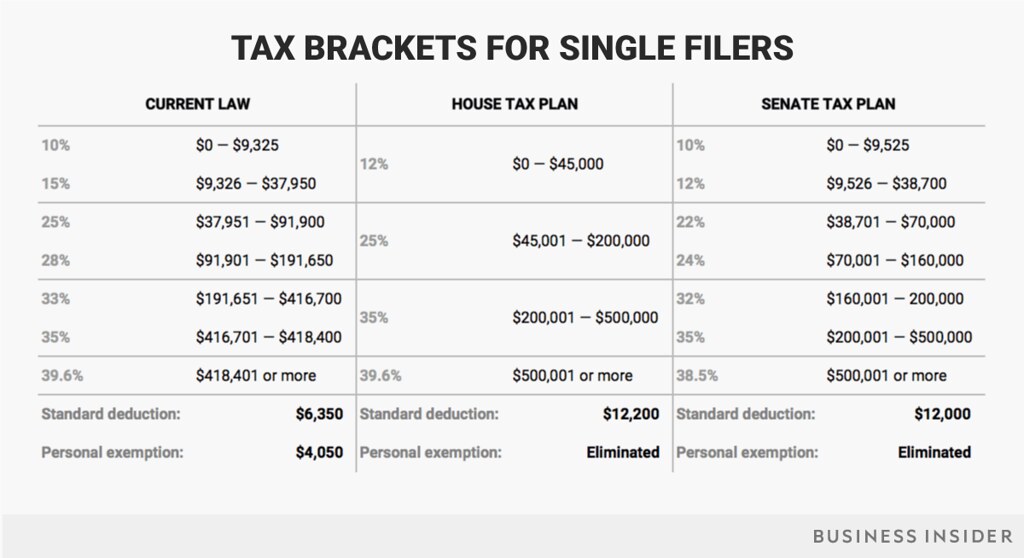

is that *after* deductions? ie - if i make $100k a year (to keep it rounded) and i get a $12k deduction, i'm now at $88k - is my rate here 12%?Proposed tax rates under the new plan:

$0 - $90,000: 12%

$90,001 - $260,000: 25%

$260,001- $1 million: 35%

More than $1 million: 39.6

- Nov 26, 2011

- 123,561

- 54,953

- 2,290

- Thread starter

- #55

I've been telling the pseudocons for YEARS that the GOP was putting on theater for the rubes. They didn't believe me.

Repealing and replacing of ObamaCare was the biggest hoax. Tax reform was the second biggest hoax.

They still haven't caught on. You know why?

Because they don't think for themselves. They sit and wait like good little marks for the hucksters to tell them what to believe. They wait for their Tard Facebook Feed to tell them what to parrot.

Do the postcard tax return. See for yourselves you are being hoaxed.

At least one trillion dollars in new debt. That's what this tax reform plan is. Because they didn't take away all the government gifts they have handed out to corporations in the tax code which caused the tax rate to be so fucking high in the first place.

Now they are lowering the corporate tax rate and not removing the gifts!

TA-DAAAAAA! You get to pay for it, rubes! The corporations get the gifts AND the lower tax rate, and you get to pay for it. Extra bonus sauce: a higher federal debt.

You don't even know what the hell I'm talking about. That's how clueless you have become. Willfully stupid.

Repealing and replacing of ObamaCare was the biggest hoax. Tax reform was the second biggest hoax.

They still haven't caught on. You know why?

Because they don't think for themselves. They sit and wait like good little marks for the hucksters to tell them what to believe. They wait for their Tard Facebook Feed to tell them what to parrot.

Do the postcard tax return. See for yourselves you are being hoaxed.

At least one trillion dollars in new debt. That's what this tax reform plan is. Because they didn't take away all the government gifts they have handed out to corporations in the tax code which caused the tax rate to be so fucking high in the first place.

Now they are lowering the corporate tax rate and not removing the gifts!

TA-DAAAAAA! You get to pay for it, rubes! The corporations get the gifts AND the lower tax rate, and you get to pay for it. Extra bonus sauce: a higher federal debt.

You don't even know what the hell I'm talking about. That's how clueless you have become. Willfully stupid.

iceberg

Diamond Member

- May 15, 2017

- 36,788

- 14,919

- 1,600

yea, sooner or later we gotta pay what we owe as a country. i'm fine with having to pay more AS LONG AS we're working to reduce spending. for me it's simple, if i don't have it i don't spend it.I'm actually okay with paying more taxes as long as the system is fair. If everyone else who earns the same income I do pays the same amount as income tax I do, then I can live with that.

Right now, we have a grossly distorted system where that is not the case.

We have to pay back all those government gifts we have been getting in the form of deductions, exemptions and credits all these years which have driven up the debt. So it should be expected some people's taxes will go up to even things out.

Eventually, we can lower the tax rates even more.

But I know for a fact the corporate tax "reform" does not level the playing field. At all.

And that is intolerable.

In fact, we should be calling this GOP plan the Intolerable Act.

It's time for revolution.

our government doesn't share that mentality.

I've been telling the pseudocons for YEARS that the GOP was putting on theater for the rubes. They didn't believe me.

Repealing and replacing of ObamaCare was the biggest hoax. Tax reform was the second biggest hoax.

They still haven't caught on. You know why?

Because they don't think for themselves. They sit and wait like good little marks for the hucksters to tell them what to believe. They wait for their Tard Facebook Feed to tell them what to parrot.

Do the postcard tax return. See for yourselves you are being hoaxed.

At least one trillion dollars in new debt. That's what this tax reform plan is. Because they didn't take away all the government gifts they have handed out to corporations in the tax code which caused the tax rate to be so fucking high in the first place.

Now they are lowering the corporate tax rate and not removing the gifts!

TA-DAAAAAA! You get to pay for it, rubes! The corporations get the gifts AND the lower tax rate, and you get to pay for it. Extra bonus sauce: a higher federal debt.

You don't even know what the hell I'm talking about. That's how clueless you have become. Willfully stupid.

" Now they are lowering the corporate tax rate and not removing the gifts!"

bingo. And to actually get corps to only make money by investing in what people want to buy, you have remove the gifts. But this is about "the gifts." Take gifts from those who don't support gop congress critters and give the gifts to those that do. LOL

Don't even bother. Hey here's an idea. How about we all vote in 2018 and 2020 and 2022 and 2024. If we did Republicans would have 20% of the seats in our governmentIts a very bad tax plan, they will shift the cost to the middle/ working class. they will do this no mater what, if we complain enough Maybe they will end up with just a bad tax bill. its worth a try. call your senator.

Bernie Sanders said poor people don't vote

Us middle class people are getting fucked because the stupid poor people are too stupid to do one thing every 2 years. JUST ONE!!!

Then the Republican game plan worked on you just like it did blacks, muslims, hispanics, gays and women. Like you they were convinced that Hillary was a worse option than Trump. And if they can't get you to vote for them at least they'll get you to stay home or vote for Gary Johnson.G5000 was warning the rubes not to vote for trump. I doubt he voted for Hillary. I sure the hell didn't, or the Oranguton either. I'd like to see my entire congressional delegation perish in a lobbyist paid for junket plane ride.Nobles Need Not Pay TaxesWell, I just did mine, and I would pay more under the new plan than I did under the current plan.

29 percent more! That's a HUGE increase!

Dammit!

You can't say us liberals didn't warn you. Here is what we were saying in 2005 about these rich Republican mother fuckers.

And if you think that's true then you deserve everything you get. The Democrats (Bill Clinton Pelosi Reed and Obama) were much better for the middle class. Are they perfect? No. But if you don't see the difference then really you aren't looking or paying attention.

Similar threads

- Replies

- 13

- Views

- 327

- Replies

- 32

- Views

- 795

- Replies

- 14

- Views

- 1K

Latest Discussions

- Replies

- 54

- Views

- 289

- Replies

- 44

- Views

- 279

- Replies

- 140

- Views

- 617

- Replies

- 21

- Views

- 111

Forum List

-

-

-

-

-

Political Satire 8037

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-

11-15-17-single-tax-brackets-current-house-senate

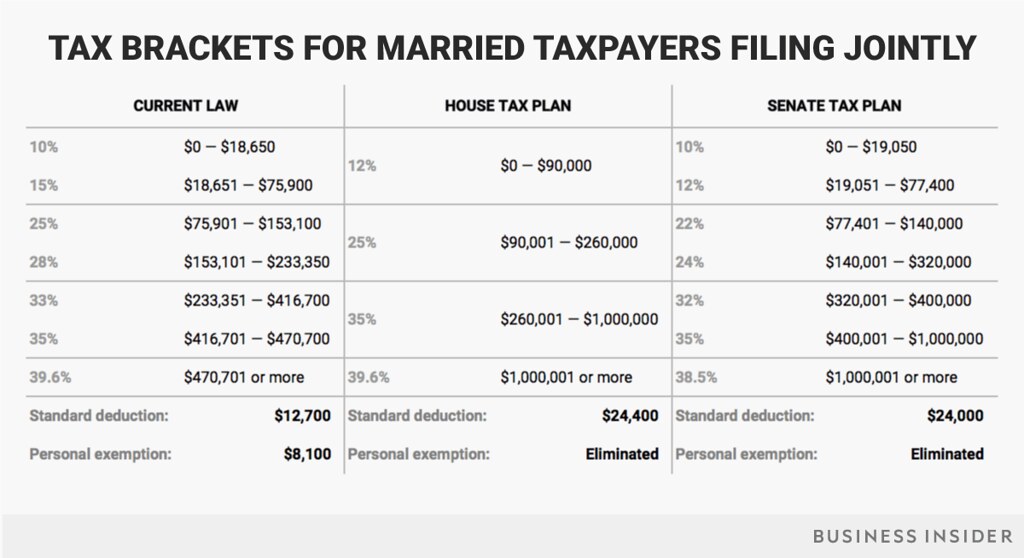

11-15-17-single-tax-brackets-current-house-senate 11-15-17-married-jointly-tax-brackets-current-house-senate

11-15-17-married-jointly-tax-brackets-current-house-senate