- Nov 26, 2011

- 123,561

- 55,014

- 2,290

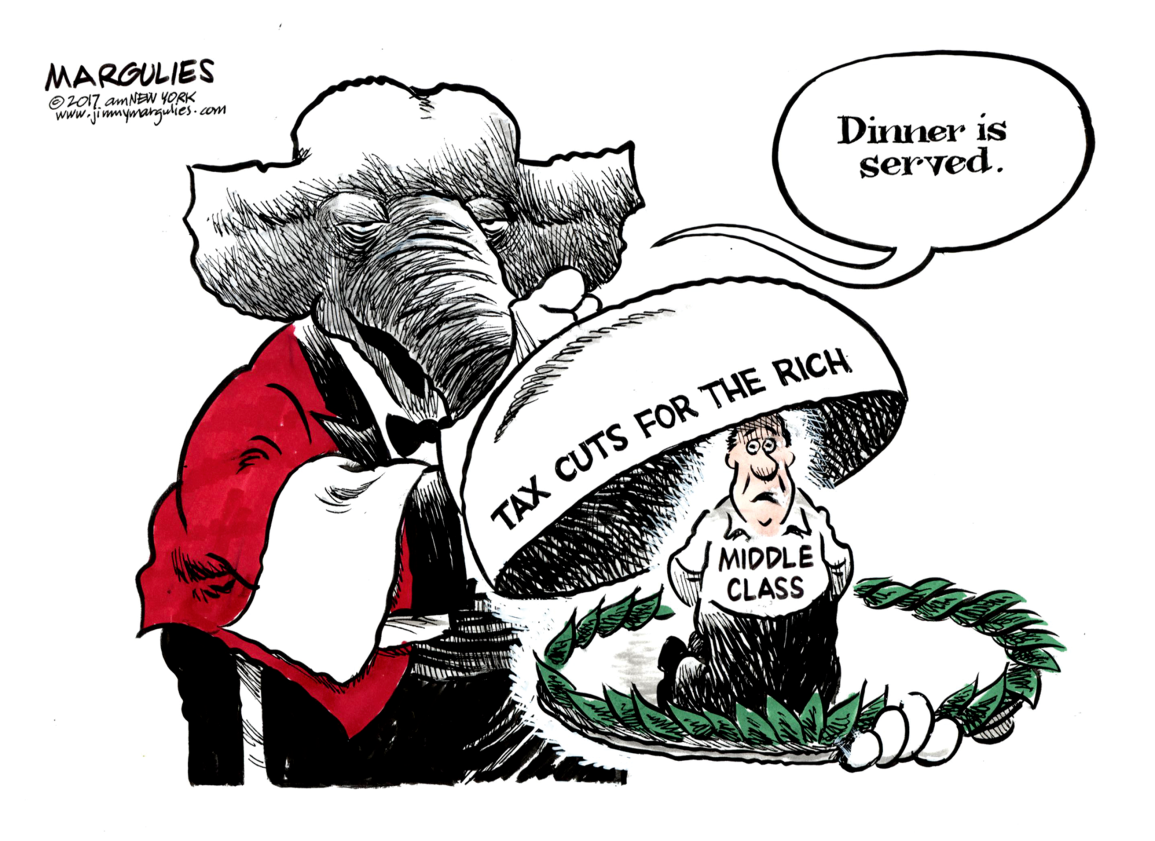

Here is the postcard tax return in the GOP tax reform plan.

Fill it out for 2016, and then compare what you would owe under the new plan to what you paid under the current system for 2016.

Tell us if you paid less, more, or the same.

Under the new GOP plan, the standard deduction is $12,000 for individuals, $18,000 for individuals with a child, and $24,000 for married couples.

The child tax credit is $1,600.

Fill it out for 2016, and then compare what you would owe under the new plan to what you paid under the current system for 2016.

Tell us if you paid less, more, or the same.

Under the new GOP plan, the standard deduction is $12,000 for individuals, $18,000 for individuals with a child, and $24,000 for married couples.

The child tax credit is $1,600.