For years Democrats lied about the effects of the Bush tax-cuts.

I guess their supporters aren't about to make them pay a price for that bold-faced lie.

Will any of you admit now that they were lying or are you going to ignore it?

CBO data - Federal individual income tax revenue trends from 2000-2009 (dollars and % GDP)

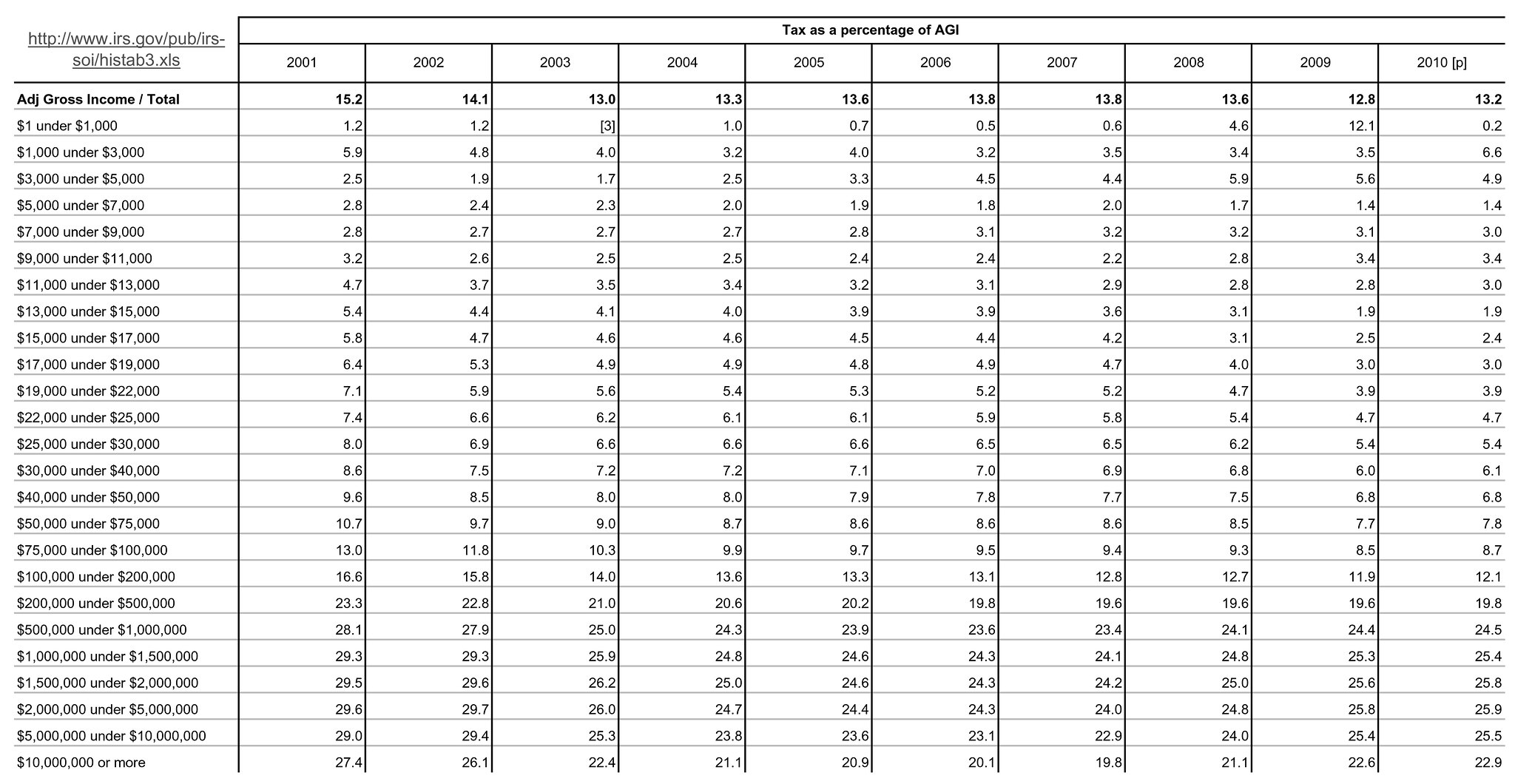

There was and is considerable controversy over who benefited from the tax cuts and whether or not they have been effective in spurring sufficient growth. Supporters of the proposal and proponents of lower taxes claimed that the tax cuts increased the pace of economic recovery and job creation. Further, proponents of the cuts asserted that lowering taxes on all citizens, including the rich, would benefit all and would actually increase receipts from the wealthiest Americans as their tax rates would decline without resort to tax shelters. The Wall Street Journal editorial page states that taxes paid by millionaire households more than doubled from $136 billion in 2003 to $274 billion in 2006 because of the JGTRRA.[2]

The Heritage Foundation concludes that the Bush tax cuts led to the rich shouldering more of the income tax burden and the poor shouldering less;[3] while the Center on Budget and Policy Priorities (CBPP) has concluded that the tax cuts have conferred the "largest benefits, by far on the highest income households." However that same publication indicates that more than 75% of tax savings (and cost to the treasury) went to households in the bottom 99% of income.[4] The underlying policy has been criticized by Democratic Party congressional opponents for giving tax cuts to the rich with capital gains tax breaks while acknowledging some benefit extended to middle and lower income brackets as well.[5]

Links

Bush tax cuts - Wikipedia, the free encyclopedia

Center on Budget and Policy Priorities - Wikipedia, the free encyclopedia

Last edited: