- Dec 31, 2011

- 1,418

- 466

- 200

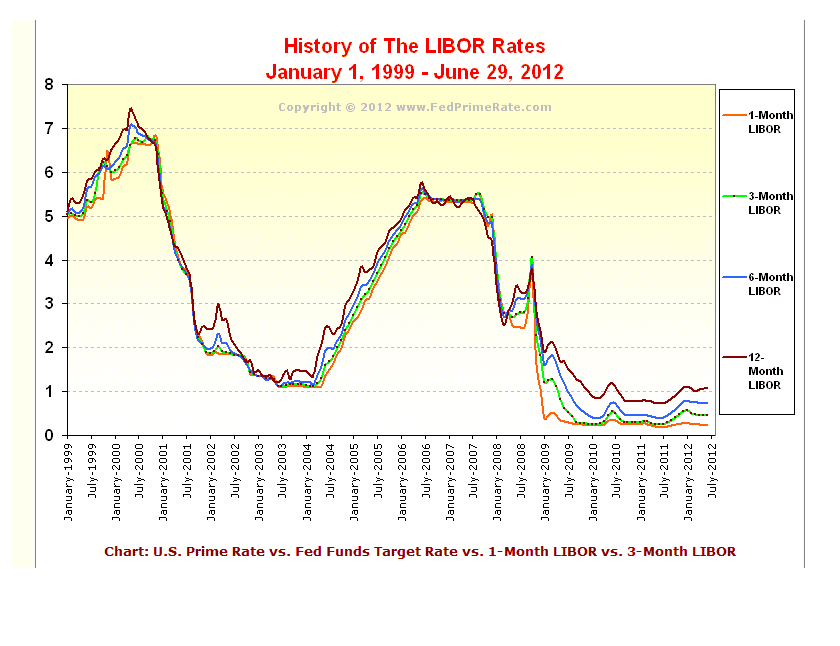

Barclays Employee to NY Fed, 2008: we know that were not posting um, an honest Libor

Although the New York Fed conferred with Britain and American regulators about the problems and recommended reforms, it failed to stop the illegal activity, which persisted through 2009 [...]

Who was the President of the NY Fed during this period?

Tim Geithner our Current Sec Treasury.

Is it a crime to knowingly allow an illegal activity to take place?

Although the New York Fed conferred with Britain and American regulators about the problems and recommended reforms, it failed to stop the illegal activity, which persisted through 2009 [...]

Who was the President of the NY Fed during this period?

Tim Geithner our Current Sec Treasury.

Is it a crime to knowingly allow an illegal activity to take place?

Last edited: