bluesguy1952

Member

Ever notice you don't hear too much about the deficit recently? That is because it is rapidly declining.

But first some history to put it all in perspective:

From Princeton University, 2004:

During the 20th century, the Dow Jones industrial average rose 7.3 percent per year on average under Republican presidents. Under Democrats, it rose 10.3 percent.

Since World War II, Democratic presidents have increased the national debt by an average of 3.7 percent per year, and Republican presidents have increased it an average of 10.1 percent. During the same time period, the unemployment rate was, on average, 4.8 percent under Democratic presidents; it was 6.3 percent under Republicans.

The Clinton-Gore administration presided over the longest peacetime economic expansion in our history. The national debt was reduced dramatically, the industrial sector boomed, wages grew and more Americans found jobs.

In the past seven years (1997 to 2004), we have experienced the weakest job creation cycle since the Great Depression, record deficits, record household debt and a record bankruptcy rate. We have gone from being the nation with the biggest budget surplus in history to becoming the nation with the largest deficit in history.

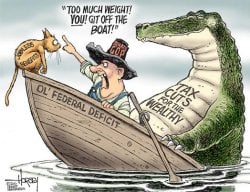

The Bush administration, supported by Republicans on Capitol Hill, pushed through a sweeping tax cut in 2001, under which the wealthiest 1 percent of Americans reaped 43 percent of the gain. In less than a year and a half, the federal government's 10-year projected budget surplus of $1.6 trillion had vanished. In 2000, we had a surplus of $236 billion. In 2004, we had a deficit of $413 billion.

Republicans pound away at the Democrats, labeling them as the "tax and spend" party. Yet recent research has shown that more than 70 percent of our national debt was created by just three Republican presidents: Reagan and the two Bushes.

But first some history to put it all in perspective:

From Princeton University, 2004:

During the 20th century, the Dow Jones industrial average rose 7.3 percent per year on average under Republican presidents. Under Democrats, it rose 10.3 percent.

Since World War II, Democratic presidents have increased the national debt by an average of 3.7 percent per year, and Republican presidents have increased it an average of 10.1 percent. During the same time period, the unemployment rate was, on average, 4.8 percent under Democratic presidents; it was 6.3 percent under Republicans.

The Clinton-Gore administration presided over the longest peacetime economic expansion in our history. The national debt was reduced dramatically, the industrial sector boomed, wages grew and more Americans found jobs.

In the past seven years (1997 to 2004), we have experienced the weakest job creation cycle since the Great Depression, record deficits, record household debt and a record bankruptcy rate. We have gone from being the nation with the biggest budget surplus in history to becoming the nation with the largest deficit in history.

The Bush administration, supported by Republicans on Capitol Hill, pushed through a sweeping tax cut in 2001, under which the wealthiest 1 percent of Americans reaped 43 percent of the gain. In less than a year and a half, the federal government's 10-year projected budget surplus of $1.6 trillion had vanished. In 2000, we had a surplus of $236 billion. In 2004, we had a deficit of $413 billion.

Republicans pound away at the Democrats, labeling them as the "tax and spend" party. Yet recent research has shown that more than 70 percent of our national debt was created by just three Republican presidents: Reagan and the two Bushes.