TakeAStepBack

Gold Member

- Mar 29, 2011

- 13,935

- 1,742

- 245

- Thread starter

- #21

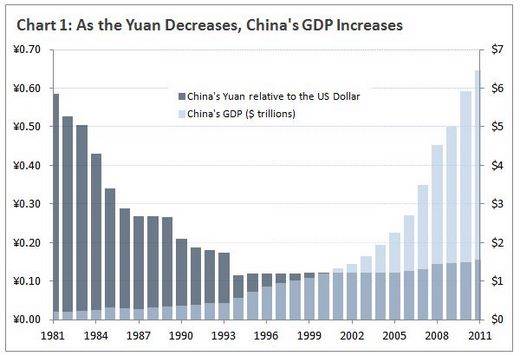

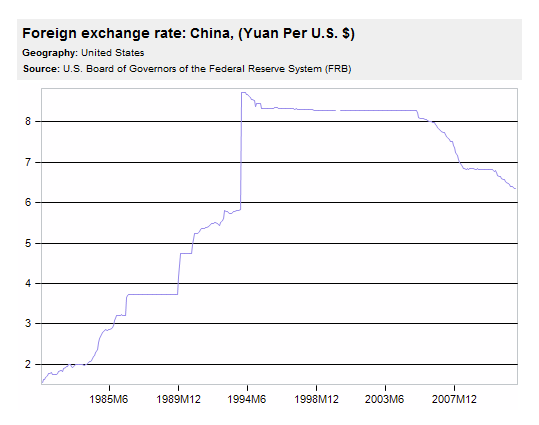

Let's stay on topic and focus on what the problem's supposed to be. Here's the historic exchange rate of yuan/dollars:...China is being accused of manipulation to undervalue. (edited for mistake in text)

Um, nobody is saying China had anything to do with the federal reserve act of 1913. I was pointing out that the dollar is being devalued as you said that the devaluation was so unseen, no one has noticed it.Also, what is it that China did in 1913 to secretly devalue the dollar?

So just what is the complaint here. Are we mad because China devalued our dollar since '03 or are we mad because we want more dollar devaluation that China's been stealing from us since '80?

I think China is being accused of as follows. Which is likely where the author of the book, I'm hoping, will draw some interesting insight. I've yet to read the book.

How China manipulates its currency

The foreign exchange market and currency values can appear imposing and abstract. Yet currency is simply a commodity. Its value is set by supply and demand. The higher the supply of a currency relative to demand, the lower the value. And vice versa.

So if China wanted to decrease the value of the yuan relative to the dollar, it would simply increase both the supply of yuan and the demand for dollars by selling the former and buying the latter. A country that does this over time thus accumulates large reserves of foreign currencies. And according to data from the IMF, this is the case with China, as you can see in Chart 2.

China's accumulation of foreign currency reserves is unprecedented. It's gone from just under $4 billion in 1980 to $3.18 trillion today, most of which consists of dollars. This represents an increase of nearly 80,000%! And what does China do with all of its excess dollars? It lends many of them back to our federal government to finance its massive deficits -- $1.1 trillion, to be precise.

The impact of China's currency manipulation

With the preceding discussion in mind, the negative aspects of China's currency manipulation may not seem obvious. We print money, give it to them for their artificially cheap goods, they give it back to us with interest, we print more money to pay the interest, and on, and on. While this has contributed to a significant trade imbalance with China, the cost of our borrowing to finance the deficit has been limited effectively to the cost of printing dollars -- which nowadays we do by pressing a button on a computer.

For many years, a number of economists even believed this cycle was beneficial to the American economy. As late as 2007, a paper was published by the Federal Reserve Bank of Philadelphia, titled "Trade Deficits Aren't as Bad as You Think" (PDF file, Adobe Acrobat required). It argued that trade deficits were good because they "shift worldwide production to its most productive locations, and allow individuals to smooth out their consumption over the business cycle."

Unfortunately, this line of thinking didn't account for the volume of dollars that flooded back into the American economy. These dollars made their way into the housing sector and fueled the then-burgeoning real estate bubble. Federal Reserve Chairman Ben Bernanke calls this his "savings glut" hypothesis. The implication is that we are where we are because of these capital flows. And these capital flows are the natural consequence of China's currency manipulation. In the greatest irony of all, in fact, it's for this reason that China strictly limits capital flows into its economy.

Obama signals tougher stance on China trade practices - Los Angeles Times

I believe the US is calling on China as a manipulator to keep their currency deliberately undervalued.