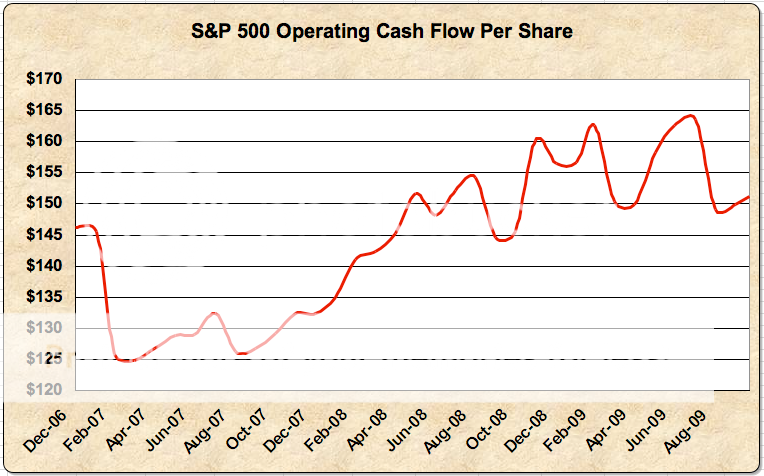

One of the more amazing pieces of data I've seen is that operating cash flows by companies in the S&P 500 are actually higher than they were before the recession.

This data is from Standard & Poor's.

The reason for this is because companies quickly shed workers and worked down inventories.

What it means is that the rebound could be harder than expected, and corporations could start hiring faster than what we, including myself, may believe.

It also corroborates the incredible growth in productivity in the second and third quarters of 6.9% and 9.5% respectively, the fastest growth in productivity in 50 years.

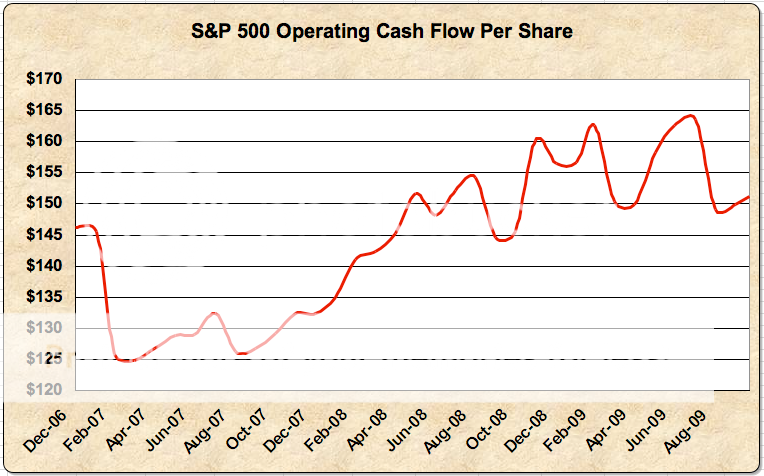

This data is from Standard & Poor's.

The reason for this is because companies quickly shed workers and worked down inventories.

What it means is that the rebound could be harder than expected, and corporations could start hiring faster than what we, including myself, may believe.

It also corroborates the incredible growth in productivity in the second and third quarters of 6.9% and 9.5% respectively, the fastest growth in productivity in 50 years.