Trajan

conscientia mille testes

Christ just what we needed, another cycle like this.

its seems to me for instance that all of the jobs getting hacked at Cisco., Lockheed Martin and Borders add up to more than jobs than have been gained over the last 2 months....(?) I could be off but I am willing to bet its fairly close.

Everyone has over the last 30-60 days or so downgraded the growth for this year and next...so, this is expected I guess.

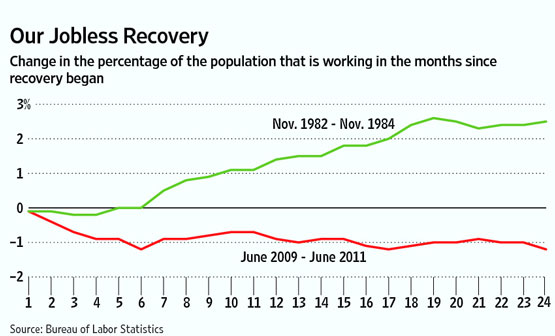

We do not appear to be making any forward progress here and this, imho represents shift backwards.....the recession ended 2 years ago.

Co.'s like Intel an all channel tech. bellwether has posted record revenue for Q2 11, but flat to lower gross profit margins......*shrugs* its OPERATING costs cut into the bottom line ( as it does with similar Co's in Manuf.) so.......layoff and capital and expense cut time....

Layoffs Deepen Gloom

JULY 21, 2011

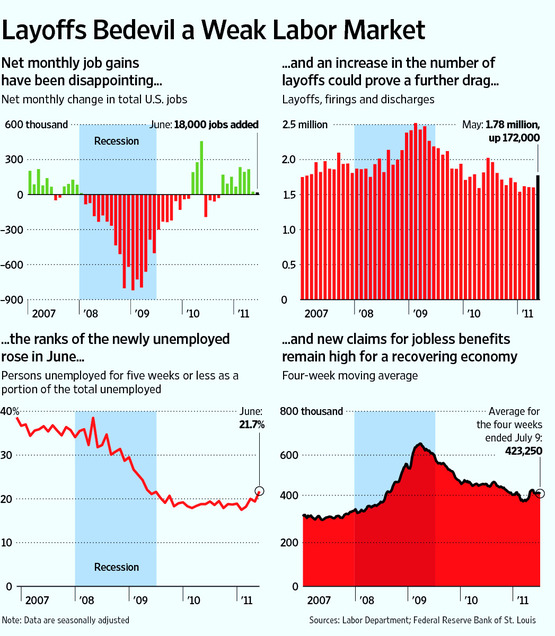

Companies are laying off employees at a level not seen in nearly a year, hobbling the job market and intensifying fears about the pace of the economic recovery.

Cisco Systems Inc., Lockheed Martin Corp. and troubled bookstore chain Borders Group Inc. are among those that have recently announced hefty cuts, while recent government numbers underscore how companies have shifted toward cutting jobs.

The increase in layoffs is a key reason why the U.S. recorded an average of only 21,500 new jobs over the past two months, far below the level needed to bring down unemployment, which now stands at 9.2%.

The cuts also reflect the shifting outlook of employers, many of whom had expected the economy to gain speed as the year progressed. Instead, growth has faltered. If the pace continues to disappoint, more companies will feel pressure to pull back. "Layoffs have played a big role [in weak job growth] over the last few months," said Mike Montgomery, an economist at IHS Global Insight. "The soft patch is more layoffs and nothing else to pick up the slack."

The trend is evident across several sectors. On Monday, following two straight quarters of lower profits, Cisco, the San Jose, Calif., networking-equipment giant, revealed plans to lay off 6,500 employees—about 9% of its staff. Goldman Sachs Group Inc., struggling with an unexpectedly steep decline in its trading business, said Tuesday that it is eliminating 1,000 jobs and indicated it may need to cut more.

snip-

In May, U.S. public and private employers shed 1.78 million workers, the highest level since August 2010. Among those layoffs, 1.66 million were from the private sector.

Other data indicate that employers are cutting more jobs. The government's most recent comprehensive jobs report, released in early July, showed the number of people out of work for less than five weeks—a figure many economists use as a proxy for layoffs, since it tallies those recently let go—grew 15.5% from May to June to a total of 3.1 million. That's the highest level for that gauge since October 2009. Meanwhile, the number of people applying for jobless benefits has been stuck at elevated levels above 400,000 a week since early April.

Behind the cuts are jittery employers whose faith in the recovery—and, by extension, consumers' willingness to spend—has been shaken. Companies are maintaining profit margins by cutting jobs and costs, and, for the moment at least, are investing in efficiency-enhancing equipment rather than new workers. Still, by turning to layoffs—which are costly in the short run as companies pay severance and restructure operations—businesses risk being caught flat-footed when the economy starts expanding at a faster clip.

more at-

Companies Step Up Layoffs - WSJ.com

its seems to me for instance that all of the jobs getting hacked at Cisco., Lockheed Martin and Borders add up to more than jobs than have been gained over the last 2 months....(?) I could be off but I am willing to bet its fairly close.

Everyone has over the last 30-60 days or so downgraded the growth for this year and next...so, this is expected I guess.

We do not appear to be making any forward progress here and this, imho represents shift backwards.....the recession ended 2 years ago.

Co.'s like Intel an all channel tech. bellwether has posted record revenue for Q2 11, but flat to lower gross profit margins......*shrugs* its OPERATING costs cut into the bottom line ( as it does with similar Co's in Manuf.) so.......layoff and capital and expense cut time....

Layoffs Deepen Gloom

JULY 21, 2011

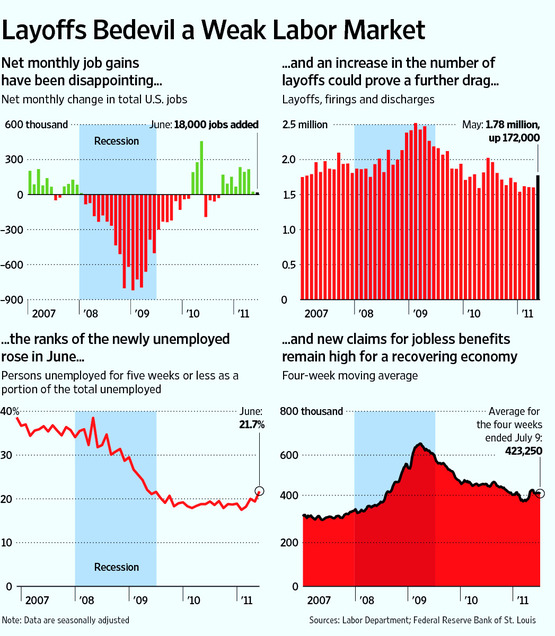

Companies are laying off employees at a level not seen in nearly a year, hobbling the job market and intensifying fears about the pace of the economic recovery.

Cisco Systems Inc., Lockheed Martin Corp. and troubled bookstore chain Borders Group Inc. are among those that have recently announced hefty cuts, while recent government numbers underscore how companies have shifted toward cutting jobs.

The increase in layoffs is a key reason why the U.S. recorded an average of only 21,500 new jobs over the past two months, far below the level needed to bring down unemployment, which now stands at 9.2%.

The cuts also reflect the shifting outlook of employers, many of whom had expected the economy to gain speed as the year progressed. Instead, growth has faltered. If the pace continues to disappoint, more companies will feel pressure to pull back. "Layoffs have played a big role [in weak job growth] over the last few months," said Mike Montgomery, an economist at IHS Global Insight. "The soft patch is more layoffs and nothing else to pick up the slack."

The trend is evident across several sectors. On Monday, following two straight quarters of lower profits, Cisco, the San Jose, Calif., networking-equipment giant, revealed plans to lay off 6,500 employees—about 9% of its staff. Goldman Sachs Group Inc., struggling with an unexpectedly steep decline in its trading business, said Tuesday that it is eliminating 1,000 jobs and indicated it may need to cut more.

snip-

In May, U.S. public and private employers shed 1.78 million workers, the highest level since August 2010. Among those layoffs, 1.66 million were from the private sector.

Other data indicate that employers are cutting more jobs. The government's most recent comprehensive jobs report, released in early July, showed the number of people out of work for less than five weeks—a figure many economists use as a proxy for layoffs, since it tallies those recently let go—grew 15.5% from May to June to a total of 3.1 million. That's the highest level for that gauge since October 2009. Meanwhile, the number of people applying for jobless benefits has been stuck at elevated levels above 400,000 a week since early April.

Behind the cuts are jittery employers whose faith in the recovery—and, by extension, consumers' willingness to spend—has been shaken. Companies are maintaining profit margins by cutting jobs and costs, and, for the moment at least, are investing in efficiency-enhancing equipment rather than new workers. Still, by turning to layoffs—which are costly in the short run as companies pay severance and restructure operations—businesses risk being caught flat-footed when the economy starts expanding at a faster clip.

more at-

Companies Step Up Layoffs - WSJ.com

Last edited:

......or, keep union member's employed becasue well, the Federal gov will now pay their salaries since the states can't ...yea thats a real design for growth......

......or, keep union member's employed becasue well, the Federal gov will now pay their salaries since the states can't ...yea thats a real design for growth......

but you know, the Russians beleive in Russian exceptionalism, like the Greeks believe in Greek exceptionalism soooo, what the heck, lets help them feel exceptional!

but you know, the Russians beleive in Russian exceptionalism, like the Greeks believe in Greek exceptionalism soooo, what the heck, lets help them feel exceptional!