Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

China spends billions to prevent stock market crash

- Thread starter guno

- Start date

The Chinese are learning how to keep things steady.

That's hilarious! You should buy some Chinese stocks on Monday, what could go wrong?

You need to learn about the present continuous.

How much did you buy?

Yeah, you just keep deflecting away from your English inability.

Keep failing.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

so what's wrong with trying to prevent a stock market crash?

who with a bit of a brain wouldn't try to prevent it?

of course you would try to prevent it. As of Monday their market was still 10% up for the year so it may not be all that serious. Also, given all the govt interference you would think the Chinese economy would produce lots of bubbles.

China is trying hard to maintain low currency.Just reading about that...seem the Chinese govt. is pumping billions to stabilize their market..The worst thing is they are playing the margins in great numbers...Could be real; bad news.........But they are still up for the year, and last year they pumped billions into the real estate market which collapsed last year... I am doubting that China will have a valuable enough yuan o try and dump the petro dollar...next year....

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

I see no evidence of that and of course neither do you which explains why you failed to provide any.China is trying hard to maintain low currency.

AdvancingTime

Senior Member

- Feb 8, 2015

- 150

- 20

- 46

Even as China's stock markets are in a free-fall the eyes of the world are fixed on Greece. Still we find the crux of world focus locked on a Euro-zone that continues a several year talkaton and is still busy wrangling over the issue of Greek default. Considering the collapse of its stock market it would seem the world should be much more worried about the economic chaos going on in China.

Remember China has about 1.4 billion people and the world's second largest GDP. It is important to note that while some risk of contagion exist from what is happening in China the real impact may not be felt for some time. China was able to manipulate its market higher last night, but that does not mean the carnage is over and the market has bottomed. The article below delves into a collapse long overdue.

http://brucewilds.blogspot.com/2015/07/china-merits-our-attention-greece-is-on.html

Remember China has about 1.4 billion people and the world's second largest GDP. It is important to note that while some risk of contagion exist from what is happening in China the real impact may not be felt for some time. China was able to manipulate its market higher last night, but that does not mean the carnage is over and the market has bottomed. The article below delves into a collapse long overdue.

http://brucewilds.blogspot.com/2015/07/china-merits-our-attention-greece-is-on.html

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

Even as China's stock markets are in a free-fall the eyes of the world are fixed on Greece. Still we find the crux of world focus locked on a Euro-zone that continues a several year talkaton and is still busy wrangling over the issue of Greek default. Considering the collapse of its stock market it would seem the world should be much more worried about the economic chaos going on in China.

Remember China has about 1.4 billion people and the world's second largest GDP. It is important to note that while some risk of contagion exist from what is happening in China the real impact may not be felt for some time. China was able to manipulate its market higher last night, but that does not mean the carnage is over and the market has bottomed. The article below delves into a collapse long overdue.

http://brucewilds.blogspot.com/2015/07/china-merits-our-attention-greece-is-on.html

collapses or runs are usually not possible anymore thanks to wiser central banking. We all learned from Friedman' understanding of the the Great Depression.

What will this mean for the United States

Nothing.

Two Thumbs

Platinum Member

b

at least that what your fellow leftist have told me

on a serious note, if china goes, it's game over for the world, just like you guys planned.

but greece had no effect on the world market b/c its so smallWhat will this mean for the United States

On Saturday, China's 21 largest brokerage firms said they would spend a whopping 120 billion yuan (about $19.3 billion) to try to stabilize the market, according to Chinese state media. The firms will actually buy stock funds themselves.

The goal is to show regular mom and pop investors that the big players still think buying stocks is a good idea. It's a similar strategy to companies buying back their stock when they think it's undervalued.

China spends billions to prevent stock market crash - Jul. 4 2015

at least that what your fellow leftist have told me

on a serious note, if china goes, it's game over for the world, just like you guys planned.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

b

but greece had no effect on the world market b/c its so smallWhat will this mean for the United States

On Saturday, China's 21 largest brokerage firms said they would spend a whopping 120 billion yuan (about $19.3 billion) to try to stabilize the market, according to Chinese state media. The firms will actually buy stock funds themselves.

The goal is to show regular mom and pop investors that the big players still think buying stocks is a good idea. It's a similar strategy to companies buying back their stock when they think it's undervalued.

China spends billions to prevent stock market crash - Jul. 4 2015

at least that what your fellow leftist have told me

on a serious note, if china goes, it's game over for the world, just like you guys planned.

game over for the world is something somebody planned??? Another stupid liberal conspiracy nut case.

Bill Angel

Gold Member

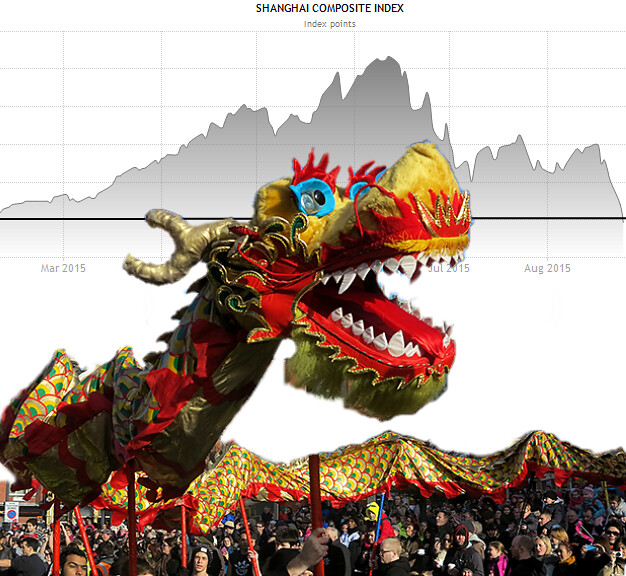

Not a Good Year ( according to the Chinese Calendar)

The chart of the Shanghai Composite Stock Index starts at the beginning of the current year according to the Chinese calendar (February 8 2015). The last date on the chart is for August 25, 2015. The bold line on the chart indicates that the index is now back where it started at the beginning of the current Chinese year.

The dragon dance, part of the Chinese New Year celebration, is performed to scare away evil spirits. The dragon is believed to be linked to good luck, long life and wisdom.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

China is a huge huge Keynesian mess. We just don't know if maintaining liquidity and other monetary measures will be enough to prevent a protracted slide.

Bill Angel

Gold Member

Many leading Information technology companies are holding considerable cash overseas.

For example:

Microsoft: 93 Billion

Apple: 70 Billion

IBM: 61 Billion

Cysco Systems: 63 Billion

Google: 47 Billion

Hewlett-Packard 43 Billion

And the list goes on.

See: U S Companies are Stashing 2.1 Trillion Overseas to Avoid Taxes

One wonders how much of these assets are being entrusted to the integrity and solvency of the Chinese banking system.

A recent news article stated that "China fell back on its major levers to stem the biggest stock market rout since 1996 and a deepening slowdown, cutting interest rates for the fifth time since November and lowering the amount of cash banks must set aside [to cover bad loans]."

See China Falls Back on Rate-Cut Lever to Stem Stock Market Rout

I should think that lowering the amount of cash that Chinese banks need to set aside to cover bad loans would make these banks more prone to failure, given China's economic problems. The question is if these banks do fail, will they take with them the assets of American corporations that might be on deposit with them?

For example:

Microsoft: 93 Billion

Apple: 70 Billion

IBM: 61 Billion

Cysco Systems: 63 Billion

Google: 47 Billion

Hewlett-Packard 43 Billion

And the list goes on.

See: U S Companies are Stashing 2.1 Trillion Overseas to Avoid Taxes

One wonders how much of these assets are being entrusted to the integrity and solvency of the Chinese banking system.

A recent news article stated that "China fell back on its major levers to stem the biggest stock market rout since 1996 and a deepening slowdown, cutting interest rates for the fifth time since November and lowering the amount of cash banks must set aside [to cover bad loans]."

See China Falls Back on Rate-Cut Lever to Stem Stock Market Rout

I should think that lowering the amount of cash that Chinese banks need to set aside to cover bad loans would make these banks more prone to failure, given China's economic problems. The question is if these banks do fail, will they take with them the assets of American corporations that might be on deposit with them?

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

Many leading Information technology companies are holding considerable cash overseas.

For example:

Microsoft: 93 Billion

Apple: 70 Billion

IBM: 61 Billion

Cysco Systems: 63 Billion

Google: 47 Billion

Hewlett-Packard 43 Billion

And the list goes on.

See: U S Companies are Stashing 2.1 Trillion Overseas to Avoid Taxes

One wonders how much of these assets are being entrusted to the integrity and solvency of the Chinese banking system.

A recent news article stated that "China fell back on its major levers to stem the biggest stock market rout since 1996 and a deepening slowdown, cutting interest rates for the fifth time since November and lowering the amount of cash banks must set aside [to cover bad loans]."

See China Falls Back on Rate-Cut Lever to Stem Stock Market Rout

I should think that lowering the amount of cash that Chinese banks need to set aside to cover bad loans would make these banks more prone to failure, given China's economic problems. The question is if these banks do fail, will they take with them the assets of American corporations that might be on deposit with them?

if China is cutting rates that's a good sign. America can't do that because the Fed has already cut them to 0%.

Do you understand?

Bill Angel

Gold Member

I understand how rate cuts can stimulate an economy. My concern was with their other action: lowering the amount of cash Chinese banks must set aside to cover bad loans."Many leading Information technology companies are holding considerable cash overseas.

For example:

Microsoft: 93 Billion

Apple: 70 Billion

IBM: 61 Billion

Cysco Systems: 63 Billion

Google: 47 Billion

Hewlett-Packard 43 Billion

And the list goes on.

See: U S Companies are Stashing 2.1 Trillion Overseas to Avoid Taxes

One wonders how much of these assets are being entrusted to the integrity and solvency of the Chinese banking system.

A recent news article stated that "China fell back on its major levers to stem the biggest stock market rout since 1996 and a deepening slowdown, cutting interest rates for the fifth time since November and lowering the amount of cash banks must set aside [to cover bad loans]."

See China Falls Back on Rate-Cut Lever to Stem Stock Market Rout

I should think that lowering the amount of cash that Chinese banks need to set aside to cover bad loans would make these banks more prone to failure, given China's economic problems. The question is if these banks do fail, will they take with them the assets of American corporations that might be on deposit with them?

if China is cutting rates that's a good sign. America can't do that because the Fed has already cut them to 0%.

Do you understand?

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

I understand how rate cuts can stimulate an economy. My concern was with their other action: lowering the amount of cash Chinese banks must set aside to cover bad loans."Many leading Information technology companies are holding considerable cash overseas.

For example:

Microsoft: 93 Billion

Apple: 70 Billion

IBM: 61 Billion

Cysco Systems: 63 Billion

Google: 47 Billion

Hewlett-Packard 43 Billion

And the list goes on.

See: U S Companies are Stashing 2.1 Trillion Overseas to Avoid Taxes

One wonders how much of these assets are being entrusted to the integrity and solvency of the Chinese banking system.

A recent news article stated that "China fell back on its major levers to stem the biggest stock market rout since 1996 and a deepening slowdown, cutting interest rates for the fifth time since November and lowering the amount of cash banks must set aside [to cover bad loans]."

See China Falls Back on Rate-Cut Lever to Stem Stock Market Rout

I should think that lowering the amount of cash that Chinese banks need to set aside to cover bad loans would make these banks more prone to failure, given China's economic problems. The question is if these banks do fail, will they take with them the assets of American corporations that might be on deposit with them?

if China is cutting rates that's a good sign. America can't do that because the Fed has already cut them to 0%.

Do you understand?

well, lowering the reserve requirements is the vehicle through which interest rates are lowered. Its the same process that China learned from our Milton Friedman, the man who resolved central banking issues.

Similar threads

- Replies

- 14

- Views

- 1K

- Locked

- Replies

- 17

- Views

- 1K

- Replies

- 2

- Views

- 912

Latest Discussions

- Replies

- 210

- Views

- 754

- Replies

- 24

- Views

- 80

- Replies

- 142

- Views

- 6K

Forum List

-

-

-

-

-

Political Satire 8038

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-