Alexandre Fedorovski

Gold Member

- Dec 9, 2017

- 2,536

- 1,161

- 210

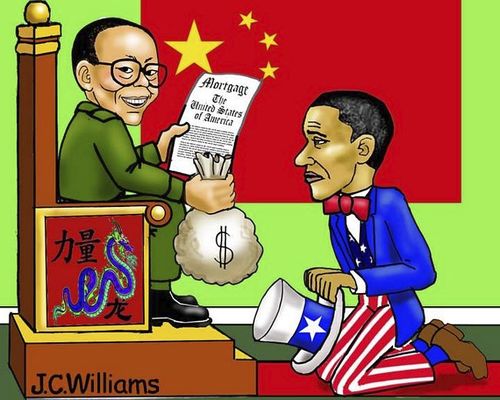

The national rating agency of China Dagong Global Credit Rating Co. on Tuesday lowered the sovereign credit ratings of the United States.

Referring to the growing dependence of the US government on attracting debt, Dagong dropped the US solvency rating for loans in national and foreign currencies by one more step - from "A-" to "BBB +" and left a "negative" outlook in place.

According to Reuters the Chinese agency estimates the economies of Peru, Colombia and Turkmenistan at the same level.

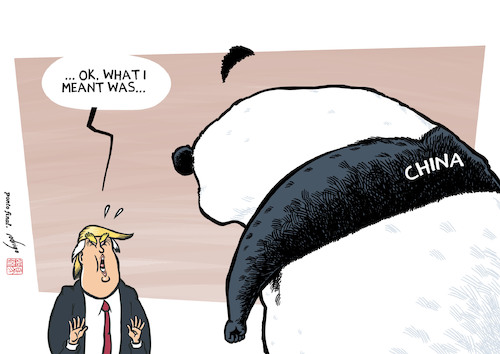

The US economic development model, based on a chronic increase in public debt, is gradually undermining the creditworthiness of the US government, Dagong believes. A new blow, according to the agency, will be a tax reduction plan proposed by the administration of Donald Trump.

Over the past 10 years, the volume of US public debt has more than doubled, and at the end of 2017, it exceeded $ 20 trillion for the first time. Of these, however, 6 trillion is an intergovernmental debt that takes into account Washington's obligations to numerous departments and state structures; The market debt, consisting of circulating securities on the market, is only $ 14 trillion.

The budget committee of the Congress forcast says that in the next 10 years, the US government's spending on loan servicing will quadruple: if current interest payments are $ 269 billion a year, or 8.1% of budget revenues, by 2027 it will be already 818 billion dollars, or 16% of all government's incomes...

Referring to the growing dependence of the US government on attracting debt, Dagong dropped the US solvency rating for loans in national and foreign currencies by one more step - from "A-" to "BBB +" and left a "negative" outlook in place.

According to Reuters the Chinese agency estimates the economies of Peru, Colombia and Turkmenistan at the same level.

The US economic development model, based on a chronic increase in public debt, is gradually undermining the creditworthiness of the US government, Dagong believes. A new blow, according to the agency, will be a tax reduction plan proposed by the administration of Donald Trump.

Over the past 10 years, the volume of US public debt has more than doubled, and at the end of 2017, it exceeded $ 20 trillion for the first time. Of these, however, 6 trillion is an intergovernmental debt that takes into account Washington's obligations to numerous departments and state structures; The market debt, consisting of circulating securities on the market, is only $ 14 trillion.

The budget committee of the Congress forcast says that in the next 10 years, the US government's spending on loan servicing will quadruple: if current interest payments are $ 269 billion a year, or 8.1% of budget revenues, by 2027 it will be already 818 billion dollars, or 16% of all government's incomes...