Widdekind

Member

- Mar 26, 2012

- 813

- 35

- 16

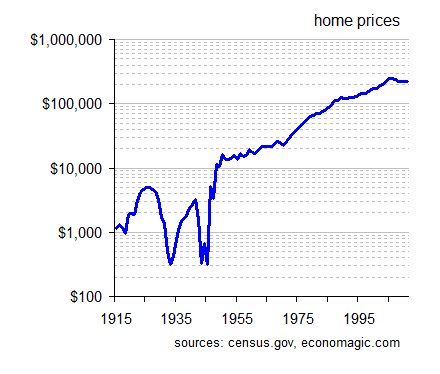

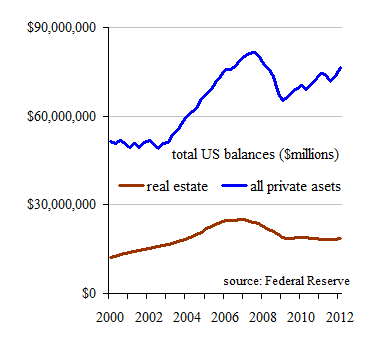

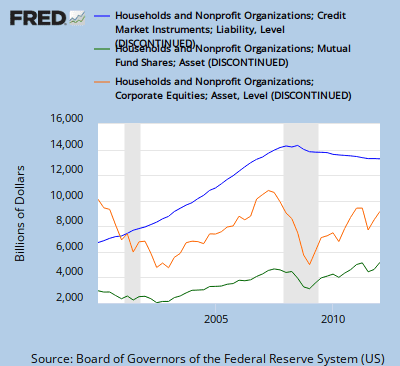

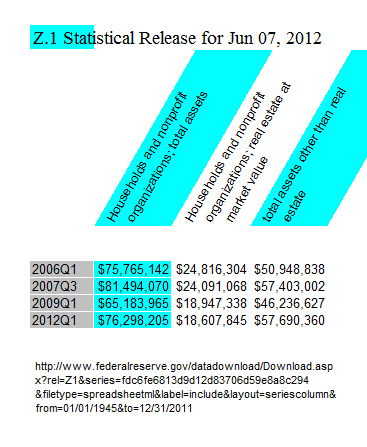

Inexpertly, risky loans were a small part of the problem. House mortgages were divided up into "shares" (mortgage backed securities (MBS)), like stock "shares" of companies. The risky loan "shares" were then "salted" into portfolios of other (seemingly) sound mortgage shares, distributing (and obfuscating) the risk. Bad loans were made, to risky borrowers, for over-priced houses. Then, when they defaulted, their bankruptcies "polluted" or "corrupted" the entire mortgage market, since their loan "shares" had been bundled together, with everybody else's. Mortgage credit evaporated. Demand-with-money(-or-credit) for houses evaporated. Prices plummeted, from debt-fueled & credit-inflated high levels; down to historic trend levels, representing the demand-with-money, for houses, of people who could actually afford houses, without the previously easy credit. Defaults on bad loans "scared away" previously easy credit; demand-with-money fell (to historic trend levels); prices fell (to historic trend levels); wealth on paper fell; debts to banks did not.The housing collapse had absolutely, positively, NOTHING to do with investing (sepculation, hedging, or anything else). It was the direct result of liberal Socialism (as usual).

The housing market collapsed because of Bill Clinton's "Community Reinvestment Act" which ensured that people who didn't previously qualify for home loans received them (because the idiot liberal - in true Communist/Marxist/Socialist fashion believes everyone should own a home, whther they can afford it or not).