The evidence continues to mount that liberals are lying about everything. The numbers are pretty astounding (and sad):

CBO Report Confirms Rich Already Pay Their "Fair Share"

CBO Report Confirms Rich Already Pay Their "Fair Share"

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

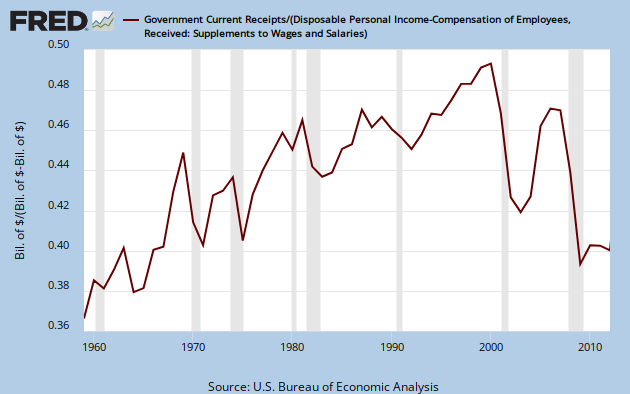

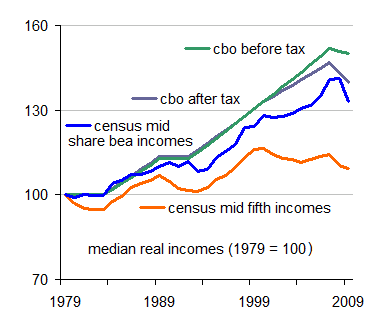

What's interesting is that we now have both the CBO and the BEA agreeing that real middle class incomes soared from 2000 to 2007, and fell after 2008:...the CBO finds that after-tax median household income rose by 48.8 percent from 1980 to 2009, after properly adjusting for shrinking household size (more singles, fewer children). The table below, constructed from CBO data, shows what happened when.

Changes in Real Median Household Income

Adjusted for Household Size

Before taxes After taxes

1979-1983 0 0

1983-1989 13.5 12.8

1989-1992 0 0

1992-2000 17.3 18.1

2000-2007 10.3 13.9

2007-2009 -4.7 -1.2

...The CBO on Falling Incomes and Rising Tax Shares of the Top 1% | Cato @ Liberty

The evidence continues to mount that liberals are lying about everything. The numbers are pretty astounding (and sad):

CBO Report Confirms Rich Already Pay Their "Fair Share"

The evidence continues to mount that liberals are lying about everything. The numbers are pretty astounding (and sad):

CBO Report Confirms Rich Already Pay Their "Fair Share"

nope, not according to our dear leader-

[L]ook, if youve been successful, you didnt get there on your own. You didnt get there on your own. Im always struck by people who think, well, it must be because I was just so smart. There are a lot of smart people out there. It must be because I worked harder than everybody else. Let me tell you something there are a whole bunch of hardworking people out there. (Applause.)

If you were successful, somebody along the line gave you some help. There was a great teacher somewhere in your life. Somebody helped to create this unbelievable American system that we have that allowed you to thrive. Somebody invested in roads and bridges. If youve got a business you didnt build that. Somebody else made that happen. The Internet didnt get invented on its own. Government research created the Internet so that all the companies could make money off the Internet.

the internet derives from the post-Soviet privatization of the "arpanet". The internet boosts information exchange & productivity. The internet represents (ultimately) tax dollars "well spent"."The Internet didnt get invented on its own. Government research created the Internet so that all the companies could make money off the Internet." - Barack Obama

...the government created "ARPANET" as a means of ensuring communications through redundancy in the event of a nuclear attack.

The internet was not created by government researchers, it was developed by private researchers who sold their work to the Dept. of Defense. We are harmed when taxes are raised and redistributed by those who ignore the private sector and try to steal the private sector's accomplishments....should taxes be raised, forevermore, in perpetual gratitude, for past successes?"The Internet didnt get invented on its own. Government research created the Internet..." - Barack Obama...

Government contracts are funded from taxes ?The internet was not created by government researchers, it was developed by private researchers who sold their work to the Dept. of Defense. We are harmed when taxes are raised and redistributed by those who ignore the private sector and try to steal the private sector's accomplishments....should taxes be raised, forevermore, in perpetual gratitude, for past successes?"The Internet didnt get invented on its own. Government research created the Internet..." - Barack Obama...

If you were successful, somebody along the line gave you some help.

Government contracts are funded from taxes ?

then Pres. Obama & Senator-candidate Warren can legitimately point to the internet, as a past success, of Publicly funded projects. Yet, successes "there-and-then" do not imply that new-and-different government programs "here-and-now" will by successful. In sports analogy, some team winning a championship, years ago, does not imply that they will win the championship, this year. Would anybody bet like that, with their own private money? Then why bet like that, with Public Money? More than "what have you done for me lately", those who advocate taxing & spending should present some cogent proposal, for some well-reasoned Public project, which would be beneficial, if funded. The internet was not funded, by blindly approving grants "for any old thing". Neither should "any new-fangled thing" be automatically pre-approved, and pre-funded, on blindly-raised taxes.Yes. Where else would the money come from?Government contracts are funded from taxes ?

technically, buyers & sellers of futures contracts are speculating, not investing. Speculation can be beneficial, e.g. farmers can lock in a lower-but-guaranteed price; and (most years) the speculators can profit on the margin. Speculation can be akin to insurance.uscitizen said:one of the traders whose companys are missing over 200 mill of "investors" money

Okay. So where else would the money come from?then Pres. Obama & Senator-candidate Warren can legitimately point to the internet, as a past success, of Publicly funded projects. Yet, successes "there-and-then" do not imply that new-and-different government programs "here-and-now" will by successful. In sports analogy, some team winning a championship, years ago, does not imply that they will win the championship, this year. Would anybody bet like that, with their own private money? Then why bet like that, with Public Money? More than "what have you done for me lately", those who advocate taxing & spending should present some cogent proposal, for some well-reasoned Public project, which would be beneficial, if funded. The internet was not funded, by blindly approving grants "for any old thing". Neither should "any new-fangled thing" be automatically pre-approved, and pre-funded, on blindly-raised taxes.Yes. Where else would the money come from?Government contracts are funded from taxes ?

I did not write what you quoted. Please learn how the quote function works before you try it again.technically, buyers & sellers of futures contracts are speculating, not investing. Speculation can be beneficial, e.g. farmers can lock in a lower-but-guaranteed price; and (most years) the speculators can profit on the margin. Speculation can be akin to insurance.one of the traders whose companys are missing over 200 mill of "investors" money

But, speculation is very different from investing (in productive capital assets). Asset price "bubbles" are caused by rampant speculation, not by investing. (Rampant investing would only lower the interest-rates businesses must pay, when they borrow, by increasing the supply of loanable money to them.)

then Pres. Obama & Senator-candidate Warren can point to the internet, as a past success, of Publicly funded projects. Successes "there-and-then" do not imply that new-and-different government programs "here-and-now" will by successful. In sports analogy, some team winning a championship, years ago, does not imply that they will win the championship, this year. Would anybody bet like that, with their own private money? Then why bet like that, with Public Money?Yes. Where else would the money come from?Government contracts are funded from taxes ?

technically, buyers & sellers of futures contracts are speculating, not investing. Speculation can be beneficial, e.g. farmers can lock in a lower-but-guaranteed price; and (most years) the speculators can profit on the margin. Speculation can be akin to insurance.one of the traders whose companys are missing over 200 mill of "investors" money