And what does the CBO identify as the main culprit in the increase in deficits?

Tax cuts! Particularly, extending the Bush tax cuts!

Not only that, the deficit will be bigger because of larger interest payments!

Congressional Budget Office - Preliminary Analysis of the President's Budget for 2012

And here is the additional interest cost of extending the tax cuts.

http://www.cbo.gov/ftpdocs/121xx/doc12103/2011-03-18-APB-PreliminaryReport.pdf

So the tax cuts would cost the US Treasury a total of $3.5 trillion, $3 trillion in revenues and $500 billion in additional interest.

Tax cuts! Particularly, extending the Bush tax cuts!

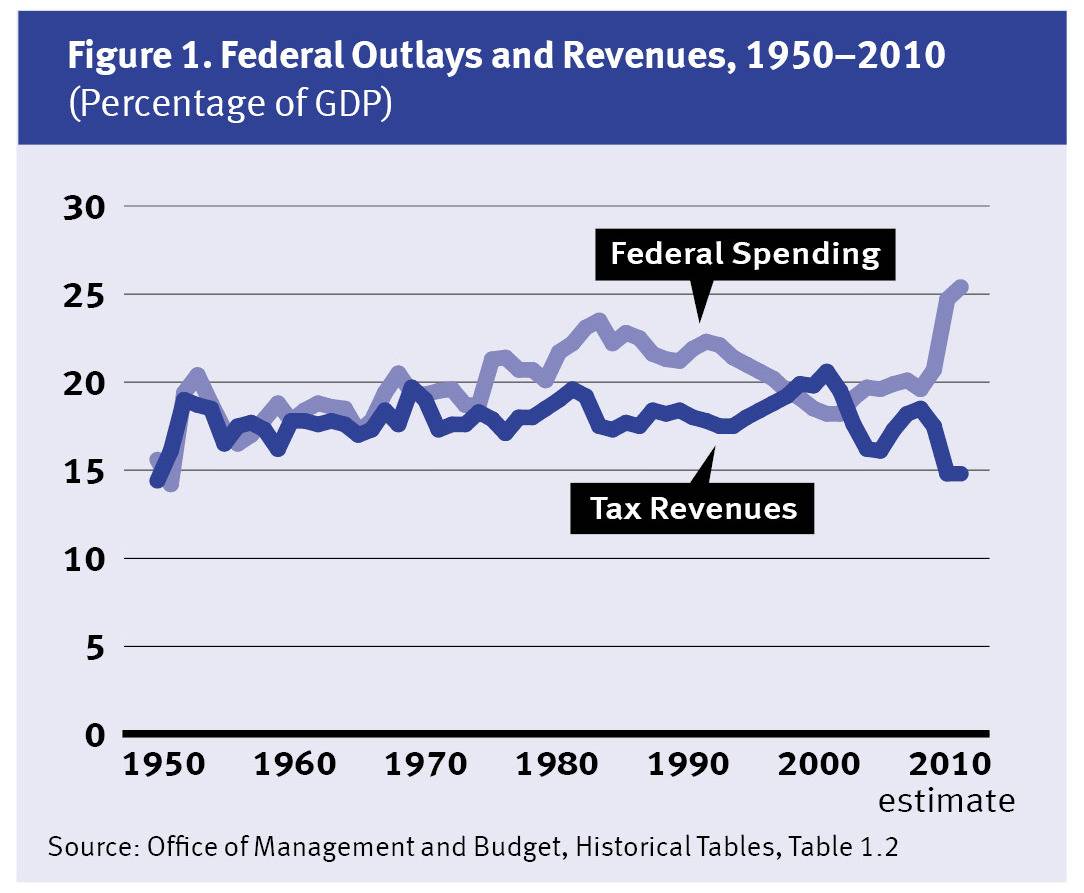

The President's policy proposals mostly affect the revenue side of the budget. Those proposals would reduce revenues, compared with CBO's baseline projections, in every year of the coming decade—for a total reduction of about 6 percent over the 2012–2021 period. ...

Of the various initiatives that the President is proposing, tax provisions would have by far the largest budgetary impact. The 2010 tax act (officially the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010, Public Law 111-312) extended through December 2012 many of the tax reductions originally enacted in the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA). The President proposes to extend those reductions permanently, with some modifications, and to permanently index for inflation the amounts of income exempt from the alternative minimum tax (AMT), starting at their 2011 levels. In addition, the President proposes that, beginning in January 2013, estate and gift taxes return permanently to the rates and exemption levels that were in effect in calendar year 2009. Those policies would reduce tax revenues and boost outlays for refundable tax credits by a total of more than $3.0 trillion over the next decade relative to the amounts projected in CBO's baseline. That total exceeds the $2.7 trillion net increase in the deficit over the next 10 years that would result from the President's budget as a whole; the President's other proposals would reduce the deficit, on balance, over 10 years.

Not only that, the deficit will be bigger because of larger interest payments!

Outlays would be greater under the President's budget than in CBO's baseline in each of the next 10 years, primarily because the proposed reduction in revenues would boost deficits and thus the costs of paying interest on the additional debt that would accumulate. In particular, net interest payments would nearly quadruple in nominal dollars (without an adjustment for inflation) over the 2012–2021 period and would increase from 1.7 percent of GDP to 3.9 percent.

Congressional Budget Office - Preliminary Analysis of the President's Budget for 2012

And here is the additional interest cost of extending the tax cuts.

The policy changes in the President’s budget would increase the government’s net outlays for interest by $2 billion in 2011 and by $519 billion between 2012 and 2021. Those increased outlays would result almost entirely from additional borrowing by the Treasury from the public to cover deficits greater than the amounts projected in the baseline.

http://www.cbo.gov/ftpdocs/121xx/doc12103/2011-03-18-APB-PreliminaryReport.pdf

So the tax cuts would cost the US Treasury a total of $3.5 trillion, $3 trillion in revenues and $500 billion in additional interest.

Last edited:

and they did not want to be called racists for not just rubber stamping everything.

and they did not want to be called racists for not just rubber stamping everything.

Scratch that, he's be hanging out with White and Nerdy rap star Weird Al.

Scratch that, he's be hanging out with White and Nerdy rap star Weird Al.