Widdekind

Member

- Mar 26, 2012

- 813

- 35

- 16

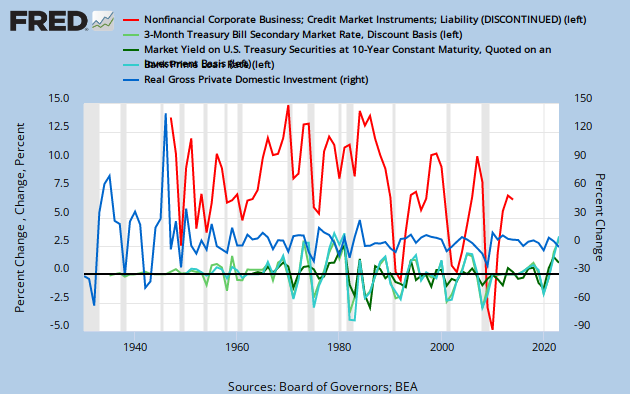

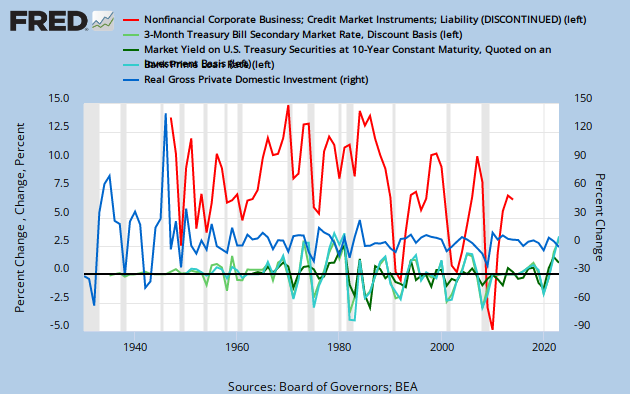

During downturns (David Romer. Advanced Macroeconomics, p.140),

- businesses stop borrowing (red line, growth rate (%) of corporate debt)

- Investment expenditures plummet (blue line, growth rate (%) of real private investment (I))

- short-term interest rates fall (solid green lines, change (%) of bank prime rate & 3-month T-bill yields)

- long-term interest rates decline (dashed green line, change (%) of 10-year T-bill yields)