eflatminor

Classical Liberal

- May 24, 2011

- 10,643

- 1,669

- 245

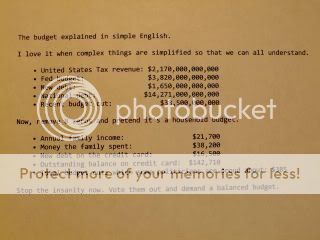

For the remedial among us...

It's immediately out of date of course. The debt is now over $15 trillion but what's a trillion between friends...

It's immediately out of date of course. The debt is now over $15 trillion but what's a trillion between friends...