April job openings show biggest drop in nearly 4 years

Job seekers were jolted Tuesday by new government data showing the number of available jobs dropped by 325,000 in April to 3.4 million.

That was the biggest single-month drop since September 2008's falloff of 438,000.

The news comes as markets await Wednesday's Federal Reserve statement on the economy at the end of a two-day meeting of its policy-setting committee. Stocks rose Tuesday in anticipation that the Fed will announce further help for an economy that has shown some signs of slowing.

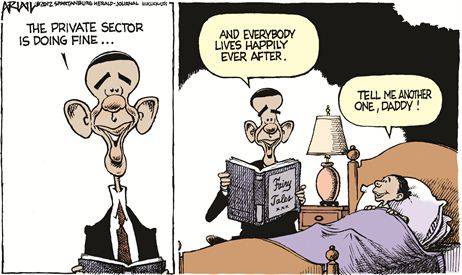

Thank god the private sector is doing fine ,as Obama says...

Job seekers were jolted Tuesday by new government data showing the number of available jobs dropped by 325,000 in April to 3.4 million.

That was the biggest single-month drop since September 2008's falloff of 438,000.

The news comes as markets await Wednesday's Federal Reserve statement on the economy at the end of a two-day meeting of its policy-setting committee. Stocks rose Tuesday in anticipation that the Fed will announce further help for an economy that has shown some signs of slowing.

Thank god the private sector is doing fine ,as Obama says...