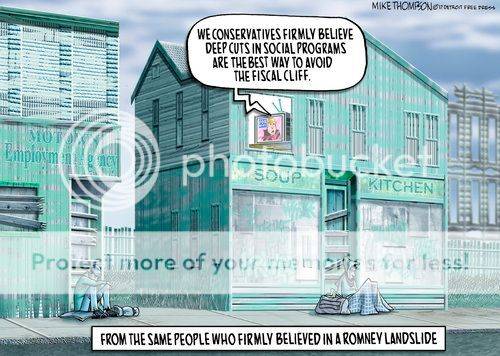

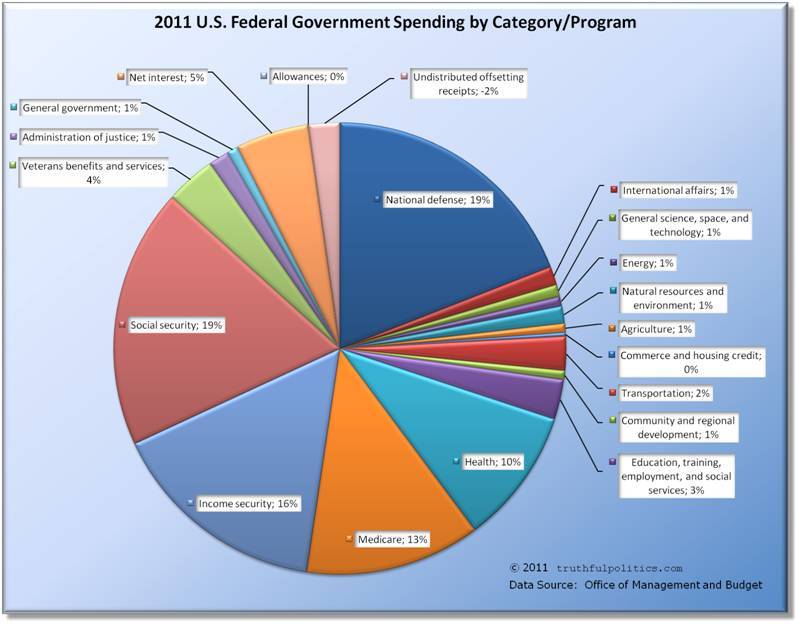

1. The looming fiscal cliff can be avoided if the parties agree to spending cuts of about $4 trillion over the next decade. Such an agreement would set specific targets for new tax revenue and spending cuts to reduce deficits by about $4 trillion over a decade, giving Congress and the president more time to work out the details. If they failed to do so, presumably other automatic changes might be in store as an enforcement action The ?Fiscal Cliff,? Explained - NYTimes.com

2. How about we cut "Glitterati Welfare": states offer refundable tax credits which can be paid to the producer whether or not the film has a tax liability. Example: if the state offers a film tax credit of $100,000, but the film only has a federal tax liability of $50,000, the state pays the full $100,000 to the producer. Even better- transferable tax credits allow the producer to sell the excess credits to a third party. Get it? The state transfers money from waitresses and truck drivers to celebrity moviemakers.

Sykes, A Nation of Moochers, p. 99.

3. According to John Stossel, the biggest welfare queens are farmers. Agricultural subsidies including direct payments, marketing loans, counter-cyclical payments, conservation subsidies, insurance, disaster aid, export subsidies, and agricultural research, taken together, have become one of the largest middle- and upper-class welfare programs in the nation.

a. Washington paid out a quarter of a trillion dollars in federal farm subsidies between 1995 and 2009, but to characterize the programs as either a big government bailout or another form of welfare would be manifestly unfair to bailouts and welfare.

Governments Continuing Bailout of Corporate Agriculture | Environmental Working Group

b. From 1995 to 2009, the largest and wealthiest top 10 percent of farm program recipients collected 74 percent of all farm subsidies, with an average total payment over 15 years of $445,127 per recipient hardly a safety net for small struggling farmers. The bottom 80 percent of farmers received an average total payment of just $8,682 per recipient. Ibid.

4. But if you want to really make your blood boil, check out the transfer payments to owners of beachfront properties. Between 1979 and 2005, Alabamas Dauphin Island was hammered six times by hurricanes, which destroyed some five hundred pricey vacation home and rental properties. Owners kept rebuilding, and the government paid more than $21 million in insurance.

http://www.washingtonpost.com/wpdyn/content/article/2005/10/10/AR2005101001465.html

a. The flood program pays every claim, doesnt raise premiums after multiple claims, and promises to keep doing so.

b. A USA TODAY review of FEMA records found that the owners of 19,600 homes and commercial buildings worth $25,000 or more have collected insurance payments that exceed the value of their property. The records exclude property addresses. In Fairhope, Ala., the owner of a $153,000 house has received $2.3 million in claims. A $116,000 Houston home has received $1.6 million. The payments are for damage to homes and what's inside .USA TODAY also found that the owners of 370,000 second homes and rental houses get huge insurance discounts. Wealthy resort areas such as Hilton Head Island, S.C., and Longboat Key, Naples and Sanibel, Fla., have some of the largest numbers of second homes and rentals getting the discounts. USATODAY.com

5. Federal civil servants earned average pay and benefits of $123,049 in 2009 while private workers made $61,051 in total compensation, according to the Bureau of Economic Analysis. The data are the latest available. Federal workers earning double their private counterparts - USATODAY.com

a. The disparity has grown from 66% in 2000, to 101% in 2009.

Federal Employees Continue to Prosper | Cato @ Liberty

b. When you compare job-to-job, which is difficult as job titles are hard to compare, total compensation for federal employees is 50% higher than private sector counterparts. Even considering skill, education, and seniority, its still a large disparity. USAToday, op.cit.

c. An apples-to-apples comparison shows that the federal pay system gives many federal workers significantly more compensation than they would get in the private sector. The total premium costs taxpayers $40 billion (according to Richwine and Biggs) or $47 billion (Sherk) per year above market rates. Federal Pay Still Inflated After Accounting for Skills

6. Then, theres this: ]Government waste at it's finest

a. Government auditors spent the past five years examining all federal programs and found that 22 percent of themcosting taxpayers a total of $123 billion annuallyfail to show any positive impact on the populations they serve

b. Examples from multiple Government Accountability Office (GAO) reports of wasteful duplication include 342 economic development programs; 130 programs serving the disabled; 130 programs serving at-risk youth; 90 early childhood development programs; 75 programs funding international education, cultural, and training exchange activities; and 72 safe water programs

c. A GAO audit classified nearly half of all purchases on government credit cards as improper, fraudulent, or embezzled. Examples of taxpayer-funded purchases include gambling, mortgage payments, liquor, lingerie, iPods, Xboxes, jewelry, Internet dating services, and Hawaiian vacations. In one extraordinary example, the Postal Service spent $13,500 on one dinner at a Ruths Chris Steakhouse, including over 200 appetizers and over $3,000 of alcohol, including more than 40 bottles of wine costing more than $50 each and brand-name liquor such as Courvoisier, Belvedere and Johnny Walker Gold. The 81 guests consumed an average of $167 worth of food and drink apiece.

7. George Washington had four cabinet departments. Since then weve added fourteen new departments, and reduced by two (Navy Department became part of Defense, and US Post Office became a quasi-corporation). How many are in line with constitutional requirements, and how many could be dispersed as state functions?

a. Department of Energy could be eliminated; President Carter created it to minimize our dependence on foreign oil, and to regulate oil prices. Good job? This department is tasked with maintaining and producing nuclear weapons. Why? What does the Pentagon do? And management of the Strategic Petroleum Reserve could, as Clinton suggested, become an outside entity. It also disperses stimulus package funds. And it runs an appliance-rebate program, and Weatherization Assistance Program, and for this it received an additional $37 billion in stimulus money, doubling its annual budget.

b. Department of Education is, of course, unconstitutional. The Constitution clearly states that powers not granted to the federal government belong to the states. So where is the impetus for its creation? Unions. The National Education Association (NEA) In 1972, the massive union formed a political action committee released Needed: A Cabinet Department of Education in 1975, but its most significant step was to endorse a presidential candidate- Jimmy Carter- for the first time in the history of the organization. D.T. Stallngs, A Brief History of the Department of Education: 1979-2002, p. 3. When formed, its budget was $13.1 billion (in 2007 dollars) and it employed 450 people. IN 2010, the estimated budget is $107 billion, and there are 4,800 employees. http://crunchycon.nationalreview.co...-department-education-not-radical/mona-charen

In November 1995, when the federal government shut down over a budget crisis, 89.4 percent of the departments employees were deemed nonessential and sent home. Beck and Balfe, Broke, p.304

Hey....how about we hold the federal government to the enumerated powers, Article I, section 8??

Bye, bye, Fannie and Freddie.....

2. How about we cut "Glitterati Welfare": states offer refundable tax credits which can be paid to the producer whether or not the film has a tax liability. Example: if the state offers a film tax credit of $100,000, but the film only has a federal tax liability of $50,000, the state pays the full $100,000 to the producer. Even better- transferable tax credits allow the producer to sell the excess credits to a third party. Get it? The state transfers money from waitresses and truck drivers to celebrity moviemakers.

Sykes, A Nation of Moochers, p. 99.

3. According to John Stossel, the biggest welfare queens are farmers. Agricultural subsidies including direct payments, marketing loans, counter-cyclical payments, conservation subsidies, insurance, disaster aid, export subsidies, and agricultural research, taken together, have become one of the largest middle- and upper-class welfare programs in the nation.

a. Washington paid out a quarter of a trillion dollars in federal farm subsidies between 1995 and 2009, but to characterize the programs as either a big government bailout or another form of welfare would be manifestly unfair to bailouts and welfare.

Governments Continuing Bailout of Corporate Agriculture | Environmental Working Group

b. From 1995 to 2009, the largest and wealthiest top 10 percent of farm program recipients collected 74 percent of all farm subsidies, with an average total payment over 15 years of $445,127 per recipient hardly a safety net for small struggling farmers. The bottom 80 percent of farmers received an average total payment of just $8,682 per recipient. Ibid.

4. But if you want to really make your blood boil, check out the transfer payments to owners of beachfront properties. Between 1979 and 2005, Alabamas Dauphin Island was hammered six times by hurricanes, which destroyed some five hundred pricey vacation home and rental properties. Owners kept rebuilding, and the government paid more than $21 million in insurance.

http://www.washingtonpost.com/wpdyn/content/article/2005/10/10/AR2005101001465.html

a. The flood program pays every claim, doesnt raise premiums after multiple claims, and promises to keep doing so.

b. A USA TODAY review of FEMA records found that the owners of 19,600 homes and commercial buildings worth $25,000 or more have collected insurance payments that exceed the value of their property. The records exclude property addresses. In Fairhope, Ala., the owner of a $153,000 house has received $2.3 million in claims. A $116,000 Houston home has received $1.6 million. The payments are for damage to homes and what's inside .USA TODAY also found that the owners of 370,000 second homes and rental houses get huge insurance discounts. Wealthy resort areas such as Hilton Head Island, S.C., and Longboat Key, Naples and Sanibel, Fla., have some of the largest numbers of second homes and rentals getting the discounts. USATODAY.com

5. Federal civil servants earned average pay and benefits of $123,049 in 2009 while private workers made $61,051 in total compensation, according to the Bureau of Economic Analysis. The data are the latest available. Federal workers earning double their private counterparts - USATODAY.com

a. The disparity has grown from 66% in 2000, to 101% in 2009.

Federal Employees Continue to Prosper | Cato @ Liberty

b. When you compare job-to-job, which is difficult as job titles are hard to compare, total compensation for federal employees is 50% higher than private sector counterparts. Even considering skill, education, and seniority, its still a large disparity. USAToday, op.cit.

c. An apples-to-apples comparison shows that the federal pay system gives many federal workers significantly more compensation than they would get in the private sector. The total premium costs taxpayers $40 billion (according to Richwine and Biggs) or $47 billion (Sherk) per year above market rates. Federal Pay Still Inflated After Accounting for Skills

6. Then, theres this: ]Government waste at it's finest

a. Government auditors spent the past five years examining all federal programs and found that 22 percent of themcosting taxpayers a total of $123 billion annuallyfail to show any positive impact on the populations they serve

b. Examples from multiple Government Accountability Office (GAO) reports of wasteful duplication include 342 economic development programs; 130 programs serving the disabled; 130 programs serving at-risk youth; 90 early childhood development programs; 75 programs funding international education, cultural, and training exchange activities; and 72 safe water programs

c. A GAO audit classified nearly half of all purchases on government credit cards as improper, fraudulent, or embezzled. Examples of taxpayer-funded purchases include gambling, mortgage payments, liquor, lingerie, iPods, Xboxes, jewelry, Internet dating services, and Hawaiian vacations. In one extraordinary example, the Postal Service spent $13,500 on one dinner at a Ruths Chris Steakhouse, including over 200 appetizers and over $3,000 of alcohol, including more than 40 bottles of wine costing more than $50 each and brand-name liquor such as Courvoisier, Belvedere and Johnny Walker Gold. The 81 guests consumed an average of $167 worth of food and drink apiece.

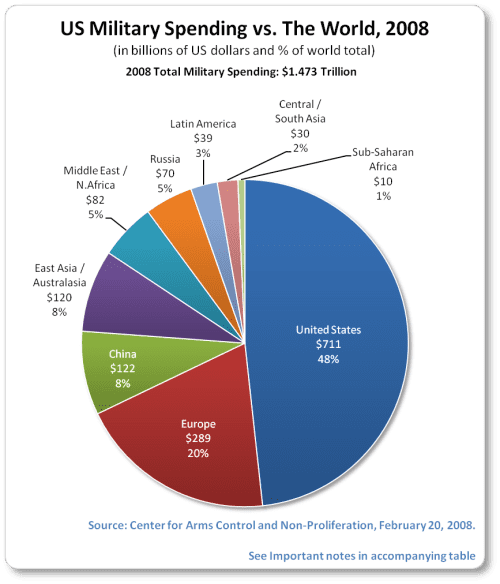

7. George Washington had four cabinet departments. Since then weve added fourteen new departments, and reduced by two (Navy Department became part of Defense, and US Post Office became a quasi-corporation). How many are in line with constitutional requirements, and how many could be dispersed as state functions?

a. Department of Energy could be eliminated; President Carter created it to minimize our dependence on foreign oil, and to regulate oil prices. Good job? This department is tasked with maintaining and producing nuclear weapons. Why? What does the Pentagon do? And management of the Strategic Petroleum Reserve could, as Clinton suggested, become an outside entity. It also disperses stimulus package funds. And it runs an appliance-rebate program, and Weatherization Assistance Program, and for this it received an additional $37 billion in stimulus money, doubling its annual budget.

b. Department of Education is, of course, unconstitutional. The Constitution clearly states that powers not granted to the federal government belong to the states. So where is the impetus for its creation? Unions. The National Education Association (NEA) In 1972, the massive union formed a political action committee released Needed: A Cabinet Department of Education in 1975, but its most significant step was to endorse a presidential candidate- Jimmy Carter- for the first time in the history of the organization. D.T. Stallngs, A Brief History of the Department of Education: 1979-2002, p. 3. When formed, its budget was $13.1 billion (in 2007 dollars) and it employed 450 people. IN 2010, the estimated budget is $107 billion, and there are 4,800 employees. http://crunchycon.nationalreview.co...-department-education-not-radical/mona-charen

In November 1995, when the federal government shut down over a budget crisis, 89.4 percent of the departments employees were deemed nonessential and sent home. Beck and Balfe, Broke, p.304

Hey....how about we hold the federal government to the enumerated powers, Article I, section 8??

Bye, bye, Fannie and Freddie.....

Indeed.

Indeed.

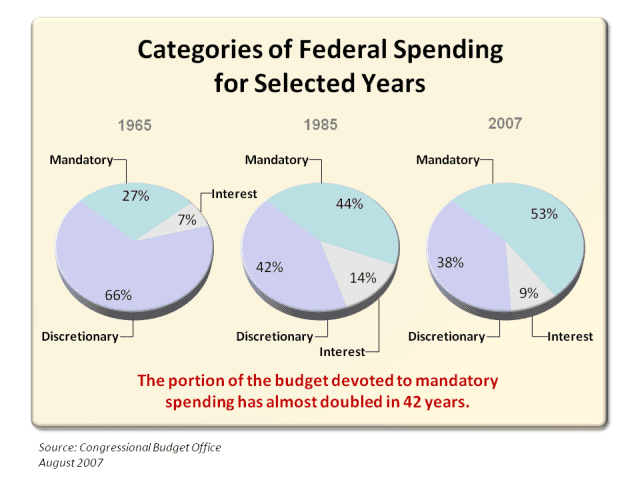

) Then there is Medicare, Medicaid, and Social Security. These are what a generally though of as "non-discretionary" items. But, in truth? There are no such things as non-discretionary items. It's all on the table. Cut it all. Even the interest payments.

) Then there is Medicare, Medicaid, and Social Security. These are what a generally though of as "non-discretionary" items. But, in truth? There are no such things as non-discretionary items. It's all on the table. Cut it all. Even the interest payments.