This is a pretty good article.

Nothing new, but needs repeating over and over and over.

Avoiding a Double Dip Recession, or Worse - FoxBusiness.com

Nothing new, but needs repeating over and over and over.

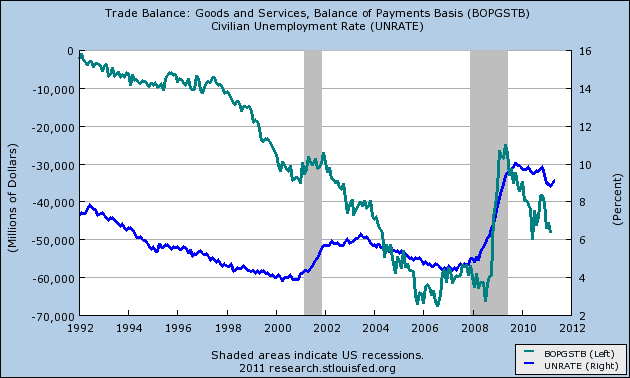

With a trade deficit exceeding 3% of GDP, either Americans borrow and spend more than they earn to keep the economy going, or the demand for U.S. made goods and services is insufficient to accomplish full employment.

Too many Americans cant find decent paying jobs, houses dont sell and prices stay depressed, and consumers dont spend. In the funk, unemployment stays above 9%, and counting adults stuck in part-time jobs or too discouraged to look, and young college graduates flipping hamburgers, it is closer to 20%.

Read more: Avoiding a Double Dip Recession, or Worse - FoxBusiness.com

Avoiding a Double Dip Recession, or Worse - FoxBusiness.com