BDBoop

Platinum Member

- Banned

- #1

Asian Stocks Drop, Extending Worst Slump Since 2009 - Bloomberg

Tomorrow promises to be a thing of beauty. Thanks, Tea Party!

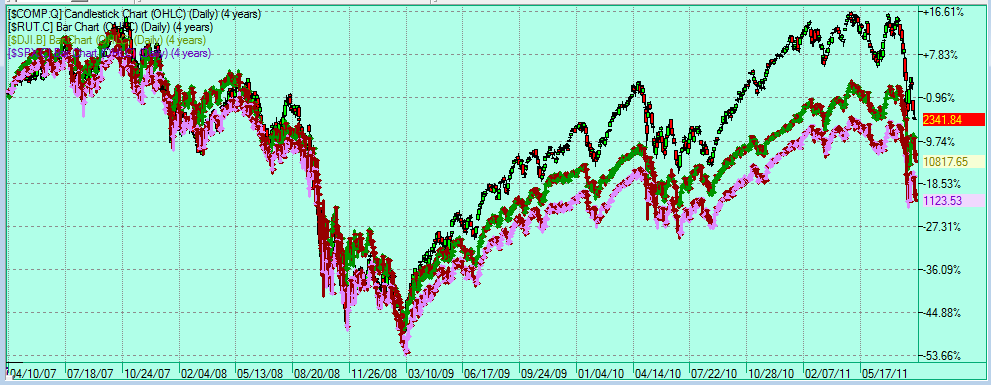

Asian stocks dropped, extending the worst global slump since the bull market began in 2009, while U.S. equity futures, 30-year Treasuries and oil slid after the loss of Americas top credit rating. Gold jumped to a record and the Swiss franc climbed to an all-time high against the dollar.

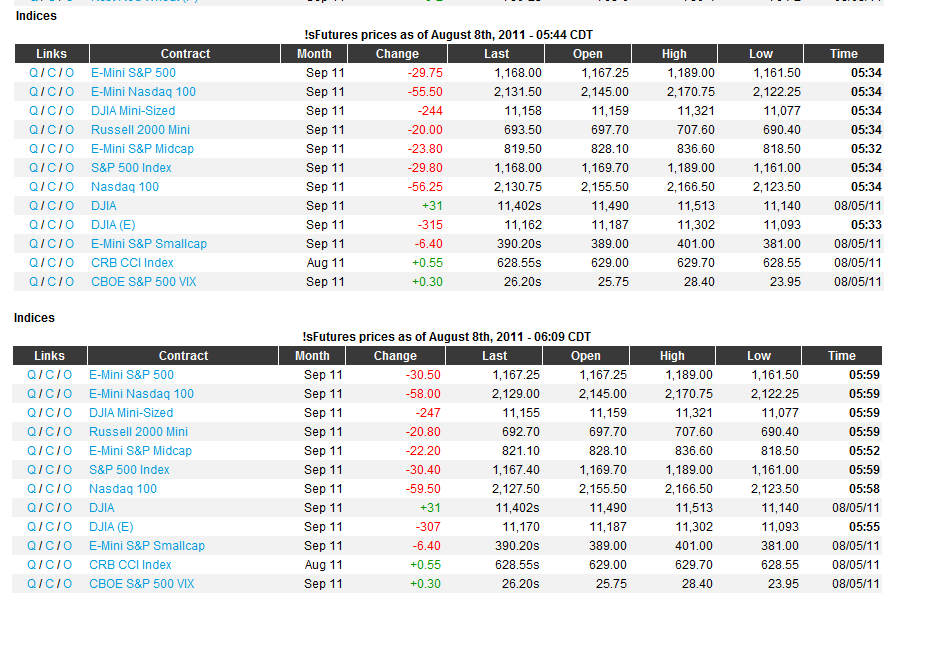

The MSCI Asia Pacific Index slid 1.5 percent at 11:20 a.m. in Tokyo. Standard & Poors 500 Index futures lost 1.8 percent, following a two-week rout that dragged the gauge down 11 percent and erased its 2011 gain. The dollar reached an all-time low of 74.85 Swiss centimes before trading at 76.15. Treasury 30-year yields climbed four basis points. Oil sank 2.9 percent in New York, while immediate-delivery gold topped $1,690 an ounce.

Tomorrow promises to be a thing of beauty. Thanks, Tea Party!