The source seems quite sound and the reading makes a lot of sense. IMHO the “losers” are those commodity market types who bet upon oil prices remaining high. The winners are clearly the common people who are finding lots of savings in just about every phase of their lives.

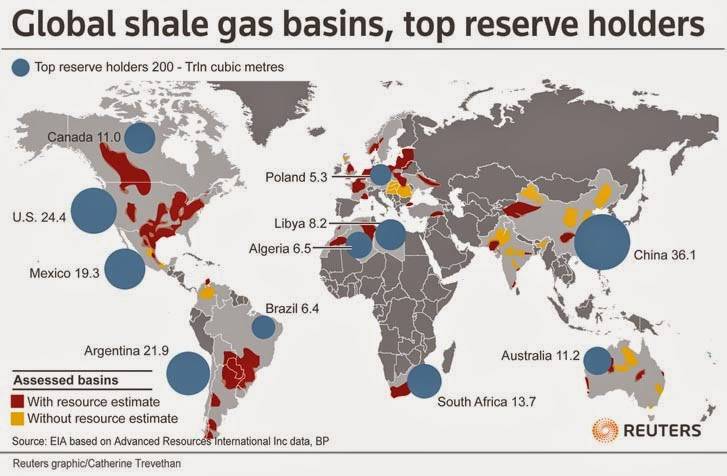

Read more @ lsquo Astonishing rsquo shale growth bolsters US power