likeabird03

Active Member

Bloomberg: "Household Wealth in U.S. Falls for Second Straight Quarter."

Household Wealth in U.S. Falls for Second Straight Quarter - Businessweek

As you can see the other thread is a just a tad out of date.

Household Wealth in U.S. Falls for Second Straight Quarter - Businessweek

As you can see the other thread is a just a tad out of date.

"By Timothy R. Homan

(Updates with details on financial assets starting in eighth paragraph.)

Dec. 8 (Bloomberg) -- Household wealth in the U.S. fell from July through September for a second straight quarter as the European debt crisis depressed stocks and home values decreased.

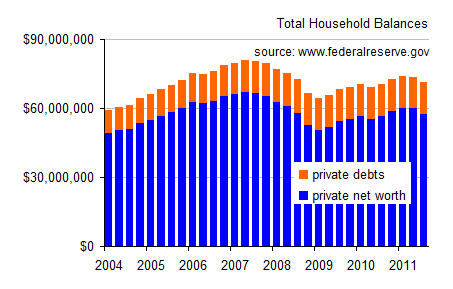

Net worth for households and non-profit groups decreased by $2.45 trillion to $57.4 trillion, the Federal Reserve said today in its flow of funds report from Washington. Americans reduced debt in the third quarter, extending a string of declines dating back three years.

A 14 percent slump in the Standard & Poors 500 Index, the worst quarter since 2008, combined with another decrease in households real estate values in the third quarter. A rebound in stocks at the end of this year and slower home-price declines may help stabilize Americans balance sheets at the same time employment growth picks up.

Were kind of in the third inning of the consumer deleveraging at this point, Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott LLC in Philadelphia, said before the report. Job growth suggests that well see some pace of increases in consumer income.

The value of household real estate decreased by $98.3 billion in the third quarter after dropping by $37 billion in the previous three months.

Owners equity as a share of total household real-estate holdings was little changed at 38.7 percent last quarter, todays report showed.

Mortgages Outstanding

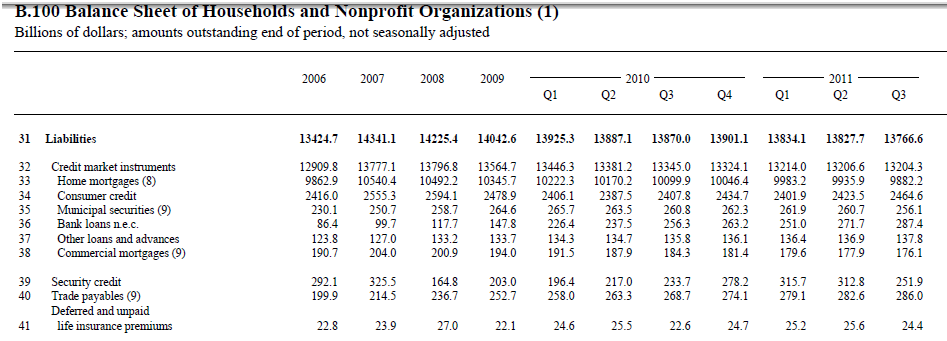

The volume of outstanding home mortgages was $9.93 trillion at the end of the second quarter, the lowest since the end of 2006, according to separate Federal Reserve data. That means U.S. mortgage debt, a driver of consumer spending during the real estate boom, may be about to enter its fourth year of decline as foreclosures wipe out home loans and housing purchases fall.

The value of financial assets, including stocks and pension fund holdings, held by American households decreased by $2.78 trillion in the third quarter, according to the flow of funds data.

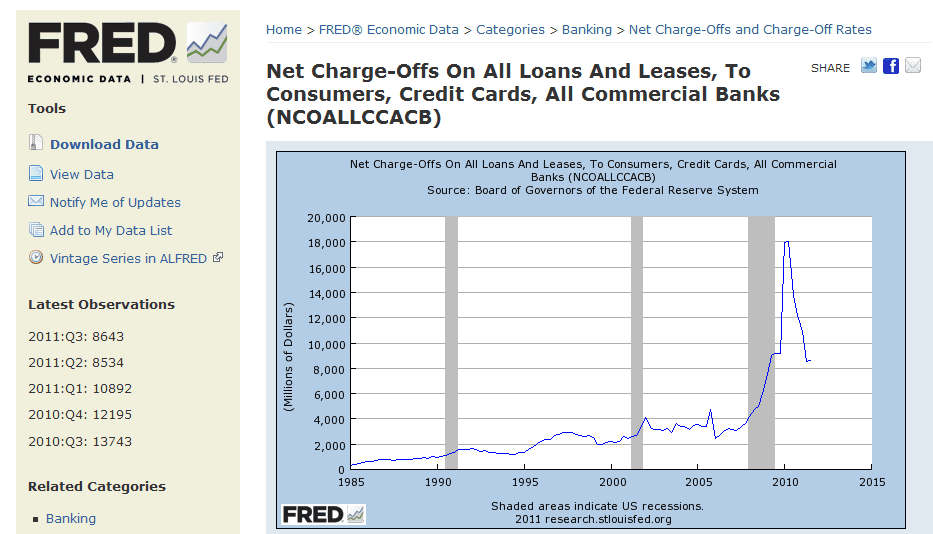

Household debt dropped at a 1.2 percent annual rate last quarter. Mortgage borrowing decreased at a 1.8 percent pace. Other forms of consumer credit, including auto and student loans, increased at a 1.2 percent pace.

Labor Market

Americans are reducing debt and rebuilding savings to weather an unemployment rate that has averaged 9 percent this year. Payrolls climbed by 120,000 in November and the jobless rate fell to 8.6 percent, the lowest level since March 2009, the Labor Department said on Dec. 2.

Ahead of the holiday shopping season, consumers were limiting their expenditures. Household spending slowed to a 0.1 percent gain in October, the smallest since a 0.2 percent drop in June, according to Commerce Department data.

Todays report also showed the balance sheets of businesses are faring better relative to households. Companies had $2.11 trillion in cash and other liquid assets at the end of the third quarter, up from $2.07 trillion in the prior three months.

Total non-financial debt last quarter rose at a 4.3 percent annual pace, led by a 14.1 percent increase by the federal government and a 3.5 percent gain among businesses. State and local government borrowing was little changed.

--Editors: Carlos Torres, Vince Golle