Your wealth of ignorance is truly astounding.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

The issue is we need to look at the big picture.

In a year and a half long recession, Americans lost $13 Trillion in their personal wealth. That is larger than the national debt that has accrued in the last 20 years. It is not just the wealthy that took that hit but anyone who owns a home or has money in a $401K.

Borrowing $2 Trillion to reverse a recession is a good investment. As much as the right wing whined about TARP bailouts....they worked

The $800 in stimulus funds still have not kicked in.

But personal wealth has gone up $2 Trillion. Anyone who questions it only has to read their most recent 401K statement or look at local real estate prices.

President Bush is the one that designed TARP.

President Bush is the one that designed TARP.

You know you're paying TRIBUTE to President G.W. Bush don't you?----

You know you're paying TRIBUTE to President G.W. Bush don't you?----

I sure do!

I am paying TRIBUTE to the $13 Trillion Americans lost in the last 18 months of Bush's presidency.

It is that $13 TRILLION that reminds Americans of what is was like when we had republicans running the country

The issue is we need to look at the big picture.

In a year and a half long recession, Americans lost $13 Trillion in their personal wealth. That is larger than the national debt that has accrued in the last 20 years. It is not just the wealthy that took that hit but anyone who owns a home or has money in a $401K.

Borrowing $2 Trillion to reverse a recession is a good investment. As much as the right wing whined about TARP bailouts....they worked

The $800 in stimulus funds still have not kicked in.

But personal wealth has gone up $2 Trillion. Anyone who questions it only has to read their most recent 401K statement or look at local real estate prices.

You know you're paying TRIBUTE to President G.W. Bush don't you?----President Bush is the one that designed TARP.

I really don't think that was your intention though--

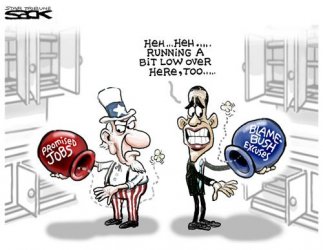

As far as Obama's 787 billion dollar economic stimulus----UPPS

View attachment 8167

You know you're paying TRIBUTE to President G.W. Bush don't you?----

I sure do!

I am paying TRIBUTE to the $13 Trillion Americans lost in the last 18 months of Bush's presidency.

It is that $13 TRILLION that reminds Americans of what is was like when we had republicans running the country

Again--a typical liberal--when cornered move on to something else. Bush did in fact design TARP. This while Obama was all over the country campaigning--you know the statement: "If they need me--I am just a phone call away."----

So what you have done now--is basically give President Bush the credit for TARP--& then come back blasting him--because you've finally realised what you just did in your original post--

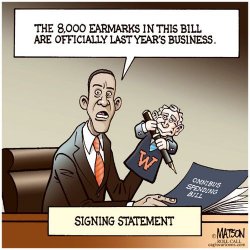

In the END---No one can BORROW & SPEND their way to PROSPERITY. And this exactly what Obama is trying to do.

View attachment 8168

I sure do!

I am paying TRIBUTE to the $13 Trillion Americans lost in the last 18 months of Bush's presidency.

It is that $13 TRILLION that reminds Americans of what is was like when we had republicans running the country

Again--a typical liberal--when cornered move on to something else. Bush did in fact design TARP. This while Obama was all over the country campaigning--you know the statement: "If they need me--I am just a phone call away."----

So what you have done now--is basically give President Bush the credit for TARP--& then come back blasting him--because you've finally realised what you just did in your original post--

In the END---No one can BORROW & SPEND their way to PROSPERITY. And this exactly what Obama is trying to do.

View attachment 8168

I have credited Bush in previous posts for his TARP efforts and also noted the republicans railed against the rescue of major banks. I also pay tribute to Bush and the republicans for triggering the largest recession in 70 years.

We lost $13 Trillion because of the recession. This is more than the total national debt!

Someone called what is happening today 10years ago.

Someone called what is happening today 10years ago.That and the Fed's ridiculous easy money policies, which kept interest rates artificially way below what they would've been in a truly free marketplace.The silver bullet to our current economic collapse started here: Pay special attention to the warning in the 4th or 5th paragraph--Someone called what is happening today 10years ago.

Fannie Mae Eases Credit To Aid Mortgage Lending - The New York Times

The silver bullet to our current economic collapse started here: Pay special attention to the warning in the 4th or 5th paragraph--Someone called what is happening today 10years ago.

Fannie Mae Eases Credit To Aid Mortgage Lending - The New York Times

That and the Fed's ridiculous easy money policies, which kept interest rates artificially way below what they would've been in a truly free marketplace.The silver bullet to our current economic collapse started here: Pay special attention to the warning in the 4th or 5th paragraph--Someone called what is happening today 10years ago.

Fannie Mae Eases Credit To Aid Mortgage Lending - The New York Times

After losing $10 Trillion in personal wealth in the last year of Bush, surging economy has already regained $2 Trillion

Americans' net worth up for first time since 2007 - Sep. 17, 2009

NEW YORK (CNNMoney.com) -- Finally!

After nearly two years of declines, the net worth of Americans rose by $2 trillion to an estimated $53.1 trillion in the second quarter compared with the first three months of the year.

The soaring stock market accounted for much of the gain. Stock holdings rose by 22% to $6.3 trillion, while mutual funds' value jumped 15% to $3.7 trillion, according to a Federal Reserve report released Thursday.

To be sure, these are not exactly flush times for many people. Unemployment stands at 9.7%, the highest level in 26 years. And many people have yet to see their home values and portfolios recover from their recent trouncing.

Since only half of Americans own stocks, with even fewer having significant holdings, only a narrow group of people benefited from Wall Street's springtime gains. The Dow Jones industrial average and the Nasdaq had their best performances since 2003 and the broader S&P 500 since 1998.

Homeowners, who make up about two-thirds of the population, also saw a little relief. Real estate rose in value for the first time since the end of 2006, climbing 2% to $18.3 trillion.

Still, Americans have a long way to go before they recover the wealth they once had. U.S. net worth peaked at $65.3 trillion in the third quarter of 2007. That's 18.7% higher than the current level.

Much of the nation's wealth had been tied to the recent booms in the housing market and on Wall Street. At the end of 2006, Americans' homes were valued at nearly $22 trillion.

And in the following year, their stock holdings topped out at $10.2 trillion and their mutual fund portfolio at $4.9 trillion.

Thursday's report is not likely to prompt consumers to resume spending, said Scott Hoyt, senior director of consumer economics at Moody's Economy.com. Wealth is still down $12 trillion from its peak and many people may see the recent increase as a blip.

"Consumers are still focused on how much wealth they've lost," Hoyt said. "They still likely see themselves in a good-size hole."

Less debt

At the same time, consumers continue to pay off their bills. Household debt shrunk by an annual rate of 1.7% in the second quarter, the fourth consecutive decline. Debt loads had never contracted until the current downturn.

Businesses are also pulling back on the debt they carry. Debt contracted at an annual rate of 1.8%, the second decline in a row.

Governments, however, are loading up on debt as they try to prop up the economy. Federal government debt ballooned 28.2%, the fourth straight increase, while state and local governments increased their debt levels by 8.3%.

After losing $10 Trillion in personal wealth in the last year of Bush, surging economy has already regained $2 Trillion

Americans' net worth up for first time since 2007 - Sep. 17, 2009

NEW YORK (CNNMoney.com) -- Finally!

After nearly two years of declines, the net worth of Americans rose by $2 trillion to an estimated $53.1 trillion in the second quarter compared with the first three months of the year.

The soaring stock market accounted for much of the gain. Stock holdings rose by 22% to $6.3 trillion, while mutual funds' value jumped 15% to $3.7 trillion, according to a Federal Reserve report released Thursday.

To be sure, these are not exactly flush times for many people. Unemployment stands at 9.7%, the highest level in 26 years. And many people have yet to see their home values and portfolios recover from their recent trouncing.

Since only half of Americans own stocks, with even fewer having significant holdings, only a narrow group of people benefited from Wall Street's springtime gains. The Dow Jones industrial average and the Nasdaq had their best performances since 2003 and the broader S&P 500 since 1998.

Homeowners, who make up about two-thirds of the population, also saw a little relief. Real estate rose in value for the first time since the end of 2006, climbing 2% to $18.3 trillion.

Still, Americans have a long way to go before they recover the wealth they once had. U.S. net worth peaked at $65.3 trillion in the third quarter of 2007. That's 18.7% higher than the current level.

Much of the nation's wealth had been tied to the recent booms in the housing market and on Wall Street. At the end of 2006, Americans' homes were valued at nearly $22 trillion.

And in the following year, their stock holdings topped out at $10.2 trillion and their mutual fund portfolio at $4.9 trillion.

Thursday's report is not likely to prompt consumers to resume spending, said Scott Hoyt, senior director of consumer economics at Moody's Economy.com. Wealth is still down $12 trillion from its peak and many people may see the recent increase as a blip.

"Consumers are still focused on how much wealth they've lost," Hoyt said. "They still likely see themselves in a good-size hole."

Less debt

At the same time, consumers continue to pay off their bills. Household debt shrunk by an annual rate of 1.7% in the second quarter, the fourth consecutive decline. Debt loads had never contracted until the current downturn.

Businesses are also pulling back on the debt they carry. Debt contracted at an annual rate of 1.8%, the second decline in a row.

Governments, however, are loading up on debt as they try to prop up the economy. Federal government debt ballooned 28.2%, the fourth straight increase, while state and local governments increased their debt levels by 8.3%.

The economy usually does better when the Democrats are in the White House.

The issue is we need to look at the big picture.

In a year and a half long recession, Americans lost $13 Trillion in their personal wealth. That is larger than the national debt that has accrued in the last 20 years. It is not just the wealthy that took that hit but anyone who owns a home or has money in a $401K.

Borrowing $2 Trillion to reverse a recession is a good investment. As much as the right wing whined about TARP bailouts....they worked

The $800 in stimulus funds still have not kicked in.

But personal wealth has gone up $2 Trillion. Anyone who questions it only has to read their most recent 401K statement or look at local real estate prices.

The 401(K) statement is just fine. When the Democrats took control of Congress in 2007, I took all my money out of the stock market. After the porkulus bill was passed, I put my money back in because free money will improve the market. The problem is you have a terrible price to pay later which is why I'll be taking my money out of the market before this happens.

The issue is we need to look at the big picture.

In a year and a half long recession, Americans lost $13 Trillion in their personal wealth. That is larger than the national debt that has accrued in the last 20 years. It is not just the wealthy that took that hit but anyone who owns a home or has money in a $401K.

Borrowing $2 Trillion to reverse a recession is a good investment. As much as the right wing whined about TARP bailouts....they worked

The $800 in stimulus funds still have not kicked in.

But personal wealth has gone up $2 Trillion. Anyone who questions it only has to read their most recent 401K statement or look at local real estate prices.

The 401(K) statement is just fine. When the Democrats took control of Congress in 2007, I took all my money out of the stock market. After the porkulus bill was passed, I put my money back in because free money will improve the market. The problem is you have a terrible price to pay later which is why I'll be taking my money out of the market before this happens.

You must have taken a bath.

The recovery will be slow. Republicans spent years destroying US financial institutions and transferring wealth from the middle class to the top 1%.

For some reason, Republicans think Obama just "gave money away". They have this rather bizarre idea that money was sent out like a reverse leaf blower.

Unless the money was used to repair bridges or dams or build roads, whoever borrowed it, has to pay it back, with interest.

http://www.nytimes.com/2009/08/31/business/economy/31taxpayer.html?_r=2&partner=rss&emc=rss

This isn't a rosy story, but at the same time, it's not all bad news.

If personal wealth is up that much that quickly then why are we still falling further into debt?

The 401(K) statement is just fine. When the Democrats took control of Congress in 2007, I took all my money out of the stock market. After the porkulus bill was passed, I put my money back in because free money will improve the market. The problem is you have a terrible price to pay later which is why I'll be taking my money out of the market before this happens.

You must have taken a bath.

The recovery will be slow. Republicans spent years destroying US financial institutions and transferring wealth from the middle class to the top 1%.

For some reason, Republicans think Obama just "gave money away". They have this rather bizarre idea that money was sent out like a reverse leaf blower.

Unless the money was used to repair bridges or dams or build roads, whoever borrowed it, has to pay it back, with interest.

http://www.nytimes.com/2009/08/31/business/economy/31taxpayer.html?_r=2&partner=rss&emc=rss

This isn't a rosy story, but at the same time, it's not all bad news.

Bath? Try reading my post again. I took my money out of the stock market before the Democrats took control of Congress and put it back in when the porkulus bill was passed. I saved about a half a million.