Conservative

Type 40

FactCheck.org : Obama and the ‘Buffett Rule’

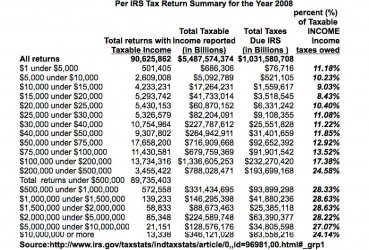

In their zeal to pass the Buffett Rule, President Obama and Vice President Biden leave the false impression that many, if not most, millionaires (people who earn $1 million or more a year) are paying a lower tax rate than the middle class. The fact is that even without the Buffett Rule more than 99 percent of millionaires will pay a higher tax rate than those in the very middle of the income range in fiscal year 2015, according to the nonpartisan Tax Policy Center.

The Tax Policy Center did an analysis of the Paying a Fair Share Act of 2012. Roberton Williams, a senior fellow at the center who spent 22 years at the nonpartisan Congressional Budget Office, wrote that even without the Buffett Rule, only about 4,000 of those with $1-million-and-above incomes will pay less than the 15 percent effective federal tax rate that middle-income households will pay in fiscal year 2015.