- Sep 19, 2011

- 28,393

- 9,970

- 900

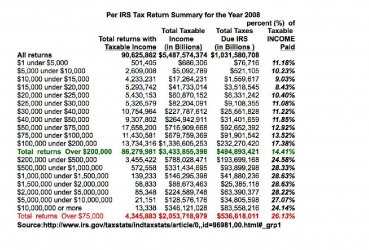

If you Obamatrons and Obama took the time to download from the IRS the following table:

Directly from the IRS tax analysis..

Source::http://www.irs.gov/taxstats/indtaxstats/article/0,,id=96981,00.html#_grp1

You'd find 28 million returns average $40,000to $52,000 adjusted income paid

less then 9.2% of their income in taxes to the IRS!

10% is LESS then Buffett's 17%

AND LESS then Obama's 20%!!

And don't give me the garbage about payroll taxes BECAUSE EVERYONE of those people will get social security PAYMENTS and Medicare from what they paid in!

This is INCOME TAXES apples to apples comparison with Obama's illustration which is a total lie when he says Buffett's secretary pays more then Buffett in taxes!

Directly from the IRS tax analysis..

Source::http://www.irs.gov/taxstats/indtaxstats/article/0,,id=96981,00.html#_grp1

You'd find 28 million returns average $40,000to $52,000 adjusted income paid

less then 9.2% of their income in taxes to the IRS!

10% is LESS then Buffett's 17%

AND LESS then Obama's 20%!!

And don't give me the garbage about payroll taxes BECAUSE EVERYONE of those people will get social security PAYMENTS and Medicare from what they paid in!

This is INCOME TAXES apples to apples comparison with Obama's illustration which is a total lie when he says Buffett's secretary pays more then Buffett in taxes!