EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

He strictly posts dogma.

too stupid but perfectly liberal!!! dogma can be correct or incorrect. Which is it and why, as if you would have any idea!!

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

He strictly posts dogma.

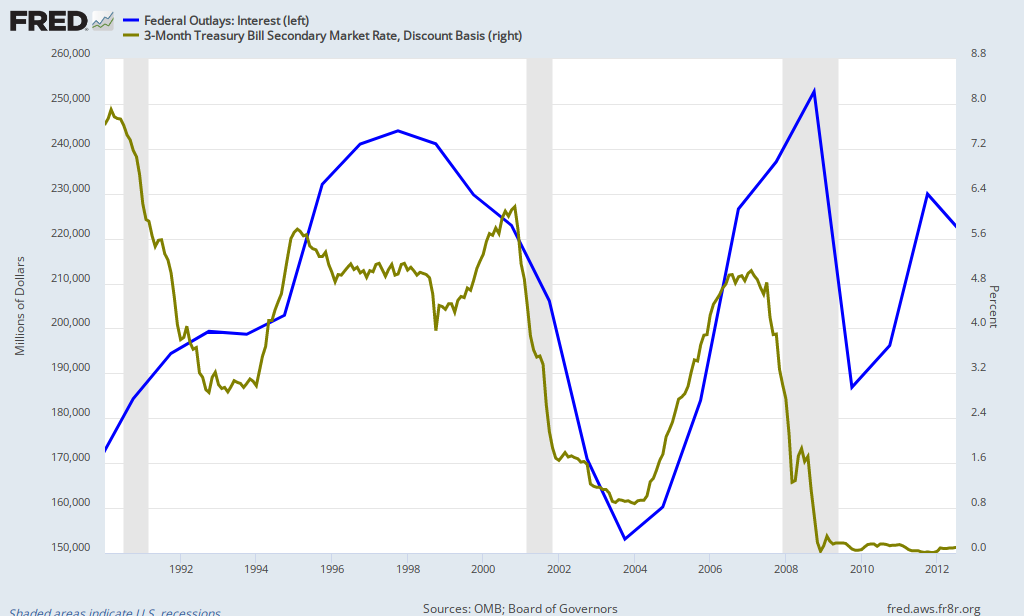

No, it's about four billion dollars a week and that's down from the $5B/week in '08.

Then again, that was back when T-bill interest rates were about 50 times what they are today. That means when rates go back up to where they were in '08 we'll be paying more like a quarter of a trillion in interest every week.

This is serious. When rates go back up to '08 levels the gov't will be paying over eleven trillion dollars in interest annually.

Anyway you look at it, democrats are nucking futs.

when rates go up the Fed will have to print money and then the end game will start.

Not necessarily and probably not the likely next step. What will happen is the federal government will default on its payments. That means any promise of payment they have, military salary, public worker salary, pensions, SS, medicare, welfare, etc...will all stop being paid out. Probably in increments.

Ask Nova. He has enough direct experience to answer that question.Does anyone have the figures on the annual costs of a peacetime government?

Do we really need to have military bases all over the world protecting liberty abroad while it is eroding here at home?

Does anyone have the figures on the annual costs of mental illness?

when rates go up the Fed will have to print money and then the end game will start.

Not necessarily and probably not the likely next step. What will happen is the federal government will default on its payments. That means any promise of payment they have, military salary, public worker salary, pensions, SS, medicare, welfare, etc...will all stop being paid out. Probably in increments.

It's a lot easier to print a bunch of money and blame it on capitalism and bad weather.