WillowTree

Diamond Member

- Sep 15, 2008

- 84,532

- 16,091

- 2,180

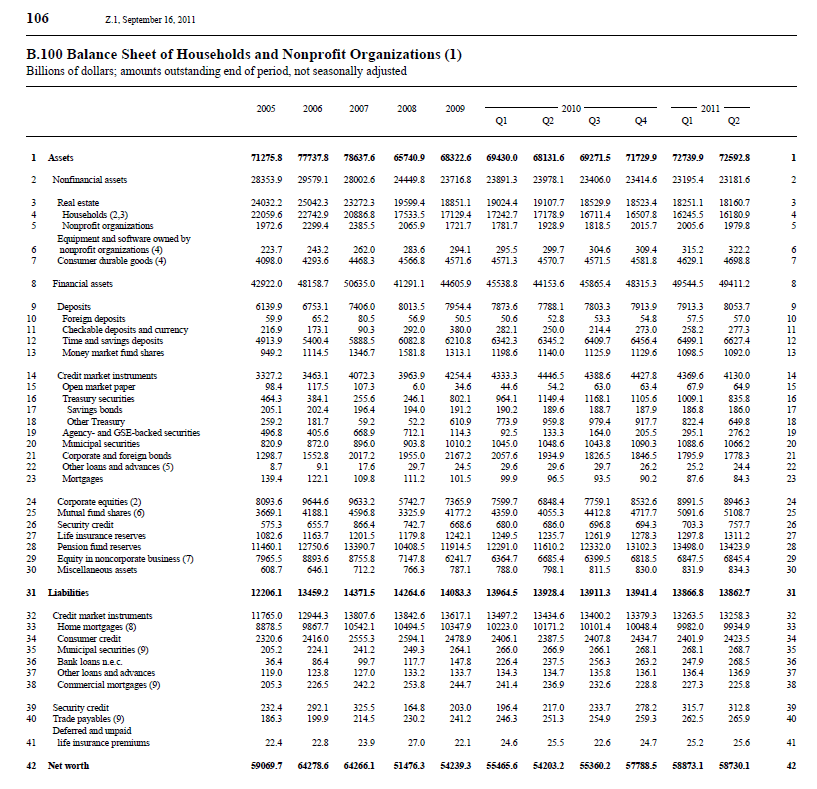

On Wednesday, the federal government's total debt exceeded fifteen trillion dollars. That's $48,000 in debt per citizen and over $133,000 in debt per taxpayer. Adding in all U.S. debt, including personal (mortgages, credit cards, student loans), plus government at all levels, the debt is approaching an incomprehensible $55 trillion, representing almost $661,000 per American family.

If you want to see just how literally big these numbers are, take a look at this screen shot from USDebtClock.org taken a couple of seconds after the fateful $15 trillion national debt was reached.

U.S. National Debt Clock : Real Time

The American Spectator : $15 Trillion and Counting

If you want to see just how literally big these numbers are, take a look at this screen shot from USDebtClock.org taken a couple of seconds after the fateful $15 trillion national debt was reached.

U.S. National Debt Clock : Real Time

The American Spectator : $15 Trillion and Counting